Image 1 of 3

Image 1 of 3

Image 2 of 3

Image 2 of 3

Image 3 of 3

Image 3 of 3

Customer Outcome Monitoring Framework

The 28-page Customer Outcome Monitoring Framework document is an FCA-aligned guide for assessing and improving retail customer outcomes under the Consumer Duty. Built on PRIN 2A.9, FG22/5, and 2025 updates, it ensures data-driven monitoring to enhance results and protect vulnerable customers, delivering up to 22% outcome gains per Q1 2025 reviews.

It details outcomes-focused, customer-centric principles and a step-by-step process for defining outcomes, analysing data, and reporting. With MI dashboards, mixed metrics, and customisable templates, it supports audits, board reporting, and SMCR accountability, aligning with the December 2024 thematic reviews for equitable and adaptive monitoring.

Includes:

Overview of Customer Outcome Monitoring in the Consumer Duty

Key FCA Requirements

Integration with the Cross-Cutting Obligations

Principles for Outcome Monitoring

Outcomes-focused and Customer-centric Monitoring

Segmentation Analysis

Qualitative and Quantitative Metrics

Remediation Actions for Poor Outcomes

Record Keeping Requirements

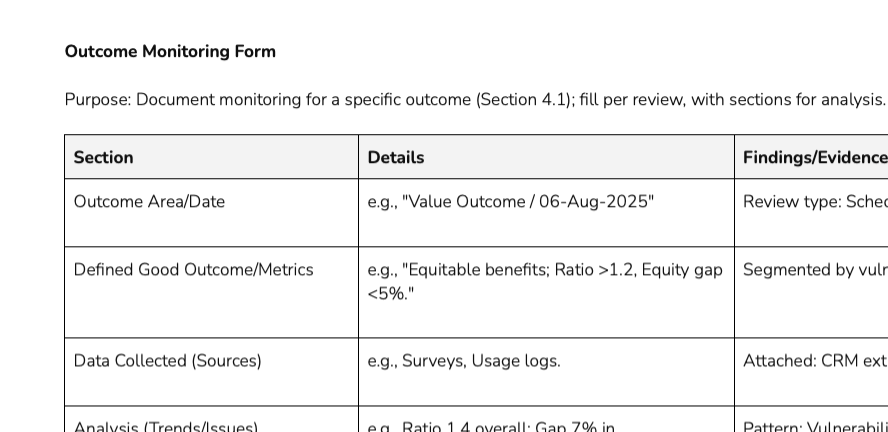

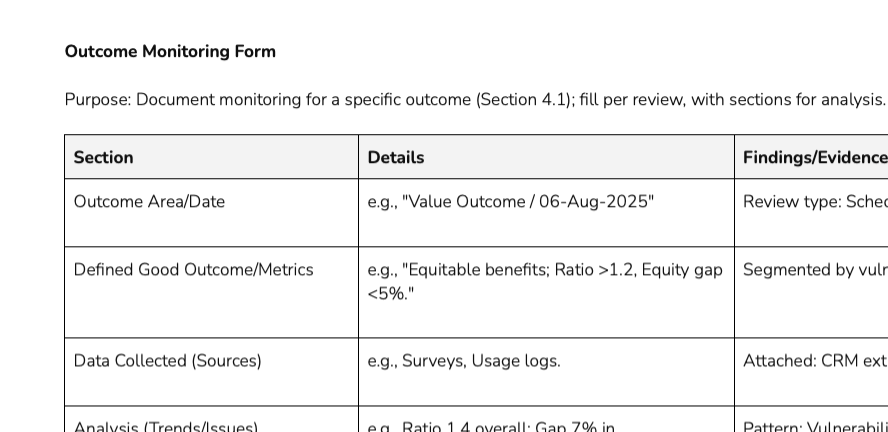

Monitoring Form Template

MI Dashboard Template

Example Completed Templates

FCA References and Resources

The 28-page Customer Outcome Monitoring Framework document is an FCA-aligned guide for assessing and improving retail customer outcomes under the Consumer Duty. Built on PRIN 2A.9, FG22/5, and 2025 updates, it ensures data-driven monitoring to enhance results and protect vulnerable customers, delivering up to 22% outcome gains per Q1 2025 reviews.

It details outcomes-focused, customer-centric principles and a step-by-step process for defining outcomes, analysing data, and reporting. With MI dashboards, mixed metrics, and customisable templates, it supports audits, board reporting, and SMCR accountability, aligning with the December 2024 thematic reviews for equitable and adaptive monitoring.

Includes:

Overview of Customer Outcome Monitoring in the Consumer Duty

Key FCA Requirements

Integration with the Cross-Cutting Obligations

Principles for Outcome Monitoring

Outcomes-focused and Customer-centric Monitoring

Segmentation Analysis

Qualitative and Quantitative Metrics

Remediation Actions for Poor Outcomes

Record Keeping Requirements

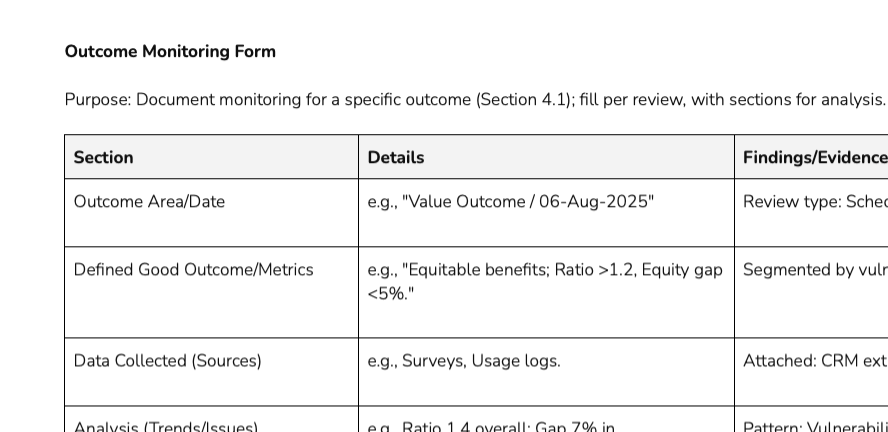

Monitoring Form Template

MI Dashboard Template

Example Completed Templates

FCA References and Resources