Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

Customer Support & Management Information Template

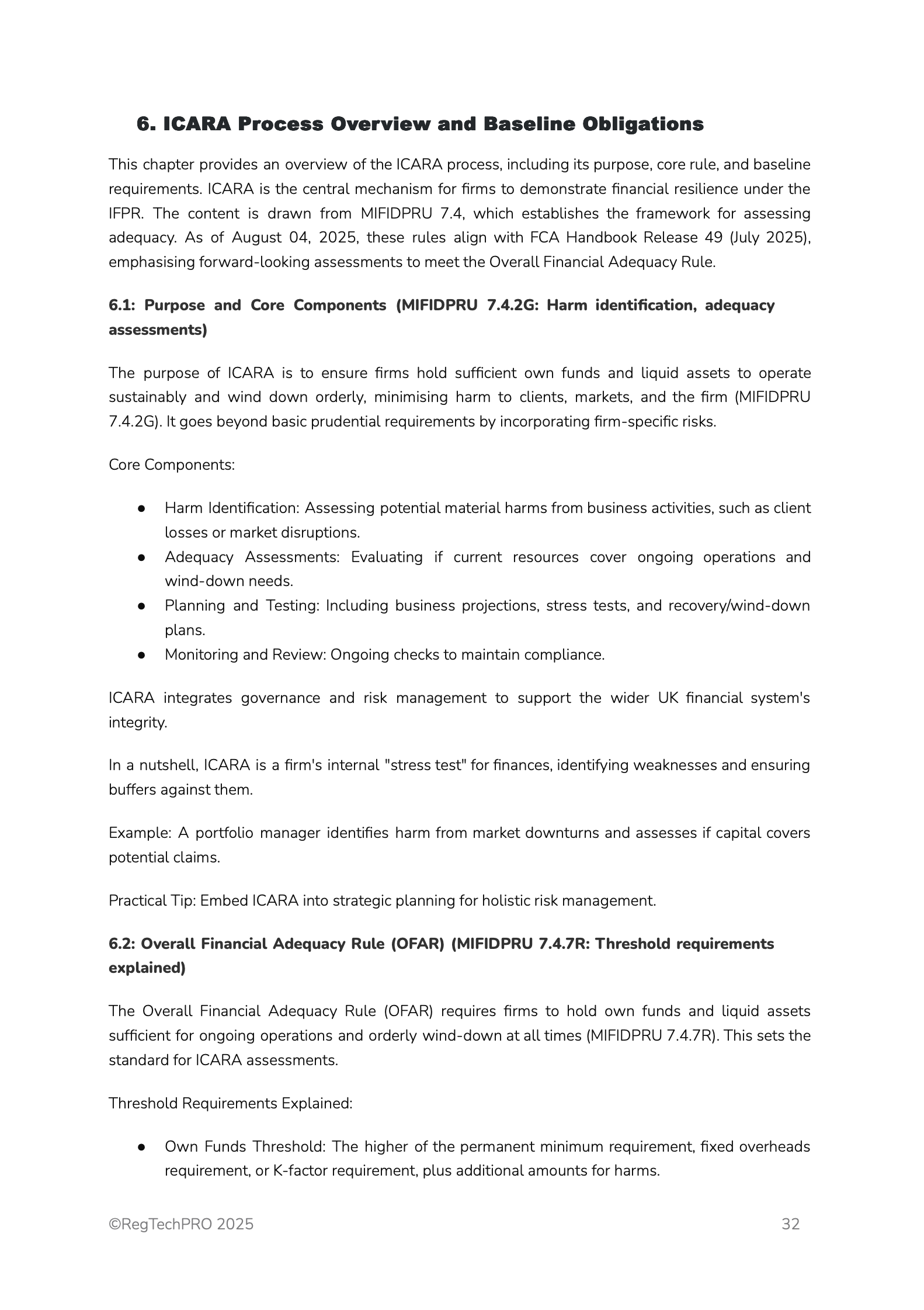

The 27-page Customer Support Monitoring Policies and MI document is an FCA-aligned guide for ensuring accessible, effective retail customer support under the Consumer Duty. Built on PRIN 2A.6, FG22/5, FS25/2 (2025 updates), and March 2025 reviews, it promotes data-driven monitoring to reduce barriers and enhance service, achieving up to 23% gains in resolution.

It outlines customer-centric and inclusive principles, along with a step-by-step process for tracking support performance across various channels. With MI dashboards, qualitative/quantitative metrics, and customizable templates, it supports audits, board reporting, and SMCR accountability, aligning with Q1 2025 thematic reviews for equitable, responsive support.

Includes:

Overview of Customer Support Monitoring in the Consumer Duty

Key FCA Requirements

Integration with the Cross-Cutting Obligations

Best Practice

Customer-Centric and Responsive Support

Accessibility and Barrier Reduction

Vulnerability and Inclusivity Focus

Policies and Processes

Review, Remediation and Adaptation

Record Keeping Requirements

Monitoring Checklist

MI Dashboard Template

Example Completed Templates

FCA References

The 27-page Customer Support Monitoring Policies and MI document is an FCA-aligned guide for ensuring accessible, effective retail customer support under the Consumer Duty. Built on PRIN 2A.6, FG22/5, FS25/2 (2025 updates), and March 2025 reviews, it promotes data-driven monitoring to reduce barriers and enhance service, achieving up to 23% gains in resolution.

It outlines customer-centric and inclusive principles, along with a step-by-step process for tracking support performance across various channels. With MI dashboards, qualitative/quantitative metrics, and customizable templates, it supports audits, board reporting, and SMCR accountability, aligning with Q1 2025 thematic reviews for equitable, responsive support.

Includes:

Overview of Customer Support Monitoring in the Consumer Duty

Key FCA Requirements

Integration with the Cross-Cutting Obligations

Best Practice

Customer-Centric and Responsive Support

Accessibility and Barrier Reduction

Vulnerability and Inclusivity Focus

Policies and Processes

Review, Remediation and Adaptation

Record Keeping Requirements

Monitoring Checklist

MI Dashboard Template

Example Completed Templates

FCA References