Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

Market Abuse Policy Template

The 40-page Market Abuse Policy Template is an FCA-aligned guide designed to prevent and detect market abuse in the financial services sector. Built on UK MAR, FCA MAR, and 2025 updates, it safeguards market integrity by addressing risks such as insider trading and market manipulation.

It details surveillance, insider list management, and STOR processes, along with customizable templates such as breach logs and compliance checklists. Supporting SMCR accountability, FCA audits, and proactive governance, it ensures robust compliance and investor trust.

Includes:

Regulatory Framework (MAR)

Our Firm’s Approach to Market Abuse Prevention

Definition and Categories of Inside Information

Access and Control Procedures

Use and Misuse of Inside Information

Delayed Disclosure Requirements and Process

Record-Keeping Obligations

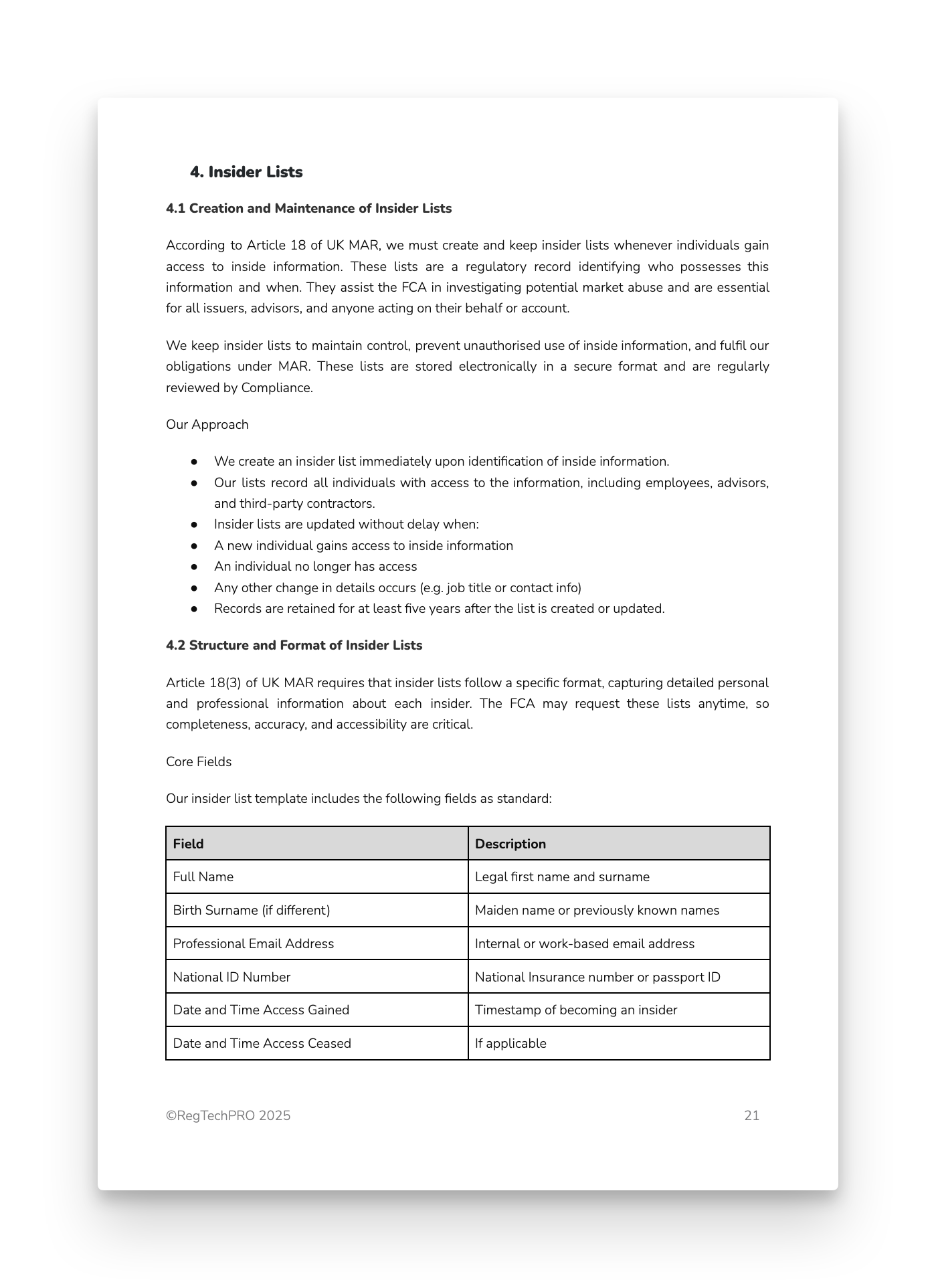

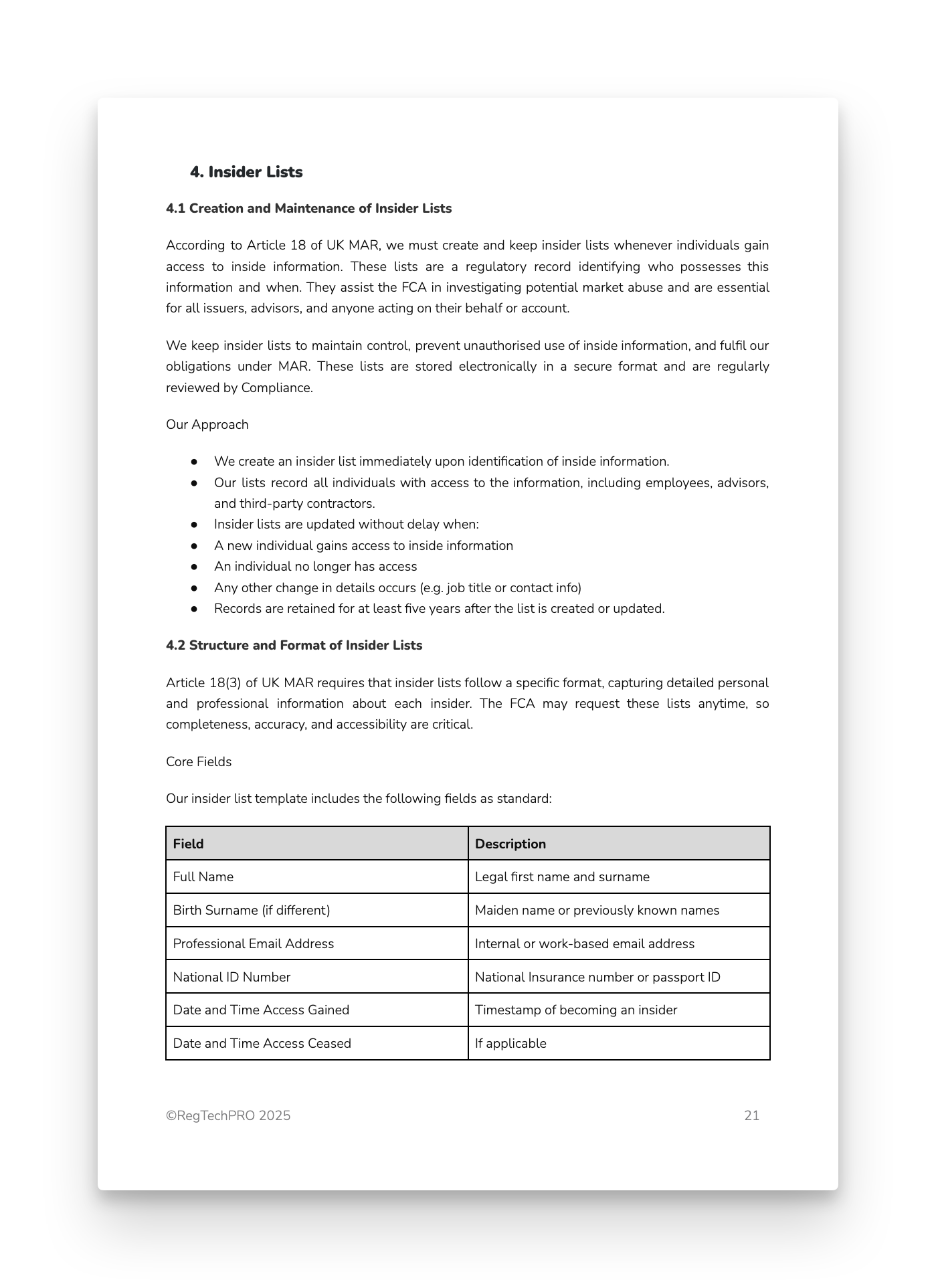

Creation and Maintenance of Insider Lists

Structure and Format of Insider Lists

Notification and Acknowledgement Process

SME Growth Market Exceptions

Personal Account Dealing and Restricted List

PA Dealing Rules and Approvals

Restricted Securities and Insider Status

Market Manipulation

Benchmark Manipulation

Detection and Monitoring Controls

Suspicious Transaction and Order Reporting (STOR)

Detection and Reporting Obligations

Tipping-Off and Confidentiality

Market Soundings

Permitted Disclosures under MAR

Consent, Warnings, and Confidentiality

Accepted Market Practices (AMPs)

Impact on Trading Behaviour

Stabilisation and Buy-Back Programmes

Permitted Stabilisation Activities

Conditions and Disclosure Requirements

Buy-Back Programme Exemptions under MAR

Media, Leaks and Market Rumours

Research Dissemination and Compliance Controls

Meetings with Analysts and Company Executives

Handling of Non-Public Information

Activist Situations and Corporate Contacts

Persons Discharging Managerial Responsibilities (PDMRs)

FCA Thresholds and Timelines

Controls for PDMRs and Closely Associated Persons

Training and Awareness

Whistleblowing and Reporting Concerns

Governance, Oversight and Breach Handling

The 40-page Market Abuse Policy Template is an FCA-aligned guide designed to prevent and detect market abuse in the financial services sector. Built on UK MAR, FCA MAR, and 2025 updates, it safeguards market integrity by addressing risks such as insider trading and market manipulation.

It details surveillance, insider list management, and STOR processes, along with customizable templates such as breach logs and compliance checklists. Supporting SMCR accountability, FCA audits, and proactive governance, it ensures robust compliance and investor trust.

Includes:

Regulatory Framework (MAR)

Our Firm’s Approach to Market Abuse Prevention

Definition and Categories of Inside Information

Access and Control Procedures

Use and Misuse of Inside Information

Delayed Disclosure Requirements and Process

Record-Keeping Obligations

Creation and Maintenance of Insider Lists

Structure and Format of Insider Lists

Notification and Acknowledgement Process

SME Growth Market Exceptions

Personal Account Dealing and Restricted List

PA Dealing Rules and Approvals

Restricted Securities and Insider Status

Market Manipulation

Benchmark Manipulation

Detection and Monitoring Controls

Suspicious Transaction and Order Reporting (STOR)

Detection and Reporting Obligations

Tipping-Off and Confidentiality

Market Soundings

Permitted Disclosures under MAR

Consent, Warnings, and Confidentiality

Accepted Market Practices (AMPs)

Impact on Trading Behaviour

Stabilisation and Buy-Back Programmes

Permitted Stabilisation Activities

Conditions and Disclosure Requirements

Buy-Back Programme Exemptions under MAR

Media, Leaks and Market Rumours

Research Dissemination and Compliance Controls

Meetings with Analysts and Company Executives

Handling of Non-Public Information

Activist Situations and Corporate Contacts

Persons Discharging Managerial Responsibilities (PDMRs)

FCA Thresholds and Timelines

Controls for PDMRs and Closely Associated Persons

Training and Awareness

Whistleblowing and Reporting Concerns

Governance, Oversight and Breach Handling