Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

Vulnerable Customers Policy + Templates

The 37-page Vulnerable Customers Policy is an FCA-aligned guide for identifying and supporting vulnerable customers under the Consumer Duty. Built on FG21/1, PRIN, and 2025 FCA updates, it ensures fair treatment and prevents harm, improving outcomes by up to 20% per recent reviews.

It outlines processes for identifying vulnerabilities, adapting interactions, and monitoring outcomes, with templates such as identification checklists and training logs. Supporting audits, SMCR accountability, and GDPR compliance, it fosters empathy and trust in the financial services sector.

Includes:

Link to FCA Principles and Consumer Duty

Defining Vulnerability

Drivers of Vulnerability (with Examples)

Assessing the Nature and Scale of Vulnerabilities

Tools and Methods for Identification

Ongoing Review of Customer Profiles

Product Design and Development

Testing and Launch

Delivery and Customer Service

Post-Sale Support and Review

Training Requirements

Recognition and Response Skills

Support for Staff

Enabling Disclosure and Recording Information

Flexible Service Provision

Inclusive Design and Communications

Data Protection Considerations

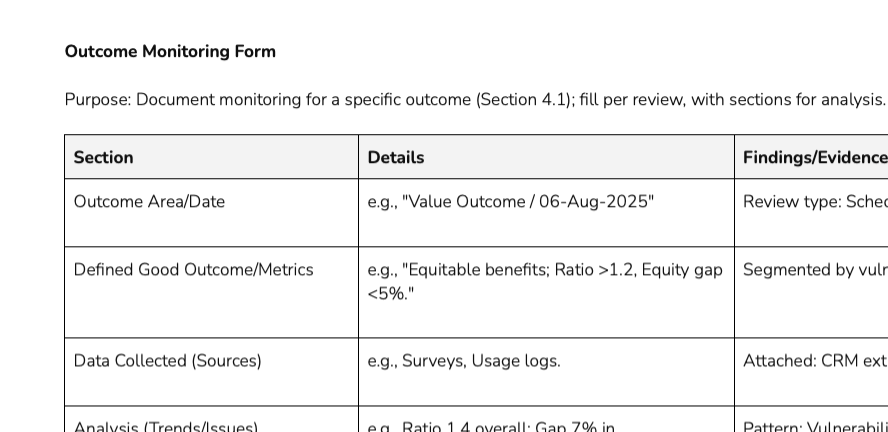

Key Metrics and Management Information (MI)

Evaluating Effectiveness

Identifying and Investigating Issues

Proportionate Remedies

Vulnerability Identification Checklist

Staff Training Log Template

Monitoring Review Template

Examples of Vulnerability Drivers

Dos and Don’ts when Dealing with and Meeting FCA Compliance Obligations for Vulnerable Customers

The 37-page Vulnerable Customers Policy is an FCA-aligned guide for identifying and supporting vulnerable customers under the Consumer Duty. Built on FG21/1, PRIN, and 2025 FCA updates, it ensures fair treatment and prevents harm, improving outcomes by up to 20% per recent reviews.

It outlines processes for identifying vulnerabilities, adapting interactions, and monitoring outcomes, with templates such as identification checklists and training logs. Supporting audits, SMCR accountability, and GDPR compliance, it fosters empathy and trust in the financial services sector.

Includes:

Link to FCA Principles and Consumer Duty

Defining Vulnerability

Drivers of Vulnerability (with Examples)

Assessing the Nature and Scale of Vulnerabilities

Tools and Methods for Identification

Ongoing Review of Customer Profiles

Product Design and Development

Testing and Launch

Delivery and Customer Service

Post-Sale Support and Review

Training Requirements

Recognition and Response Skills

Support for Staff

Enabling Disclosure and Recording Information

Flexible Service Provision

Inclusive Design and Communications

Data Protection Considerations

Key Metrics and Management Information (MI)

Evaluating Effectiveness

Identifying and Investigating Issues

Proportionate Remedies

Vulnerability Identification Checklist

Staff Training Log Template

Monitoring Review Template

Examples of Vulnerability Drivers

Dos and Don’ts when Dealing with and Meeting FCA Compliance Obligations for Vulnerable Customers