Image 1 of 4

Image 1 of 4

Image 2 of 4

Image 2 of 4

Image 3 of 4

Image 3 of 4

Image 4 of 4

Image 4 of 4

ICARA Guide and Template

The 71-page ICARA Manual & Template document is an FCA-aligned guide for managing capital and liquidity risks under MIFIDPRU. Built on FG20/1, MIFIDPRU 7, and 2025 updates, it ensures robust financial adequacy, mitigating harms to clients, markets, and firms.

It details processes for risk assessments, stress testing, and wind-down planning, with customisable templates like MIF007 forms and K-factor calculators. Supporting SMCR accountability, FCA audits, and regulatory reporting, it strengthens financial resilience and compliance.

Includes:

What is ICARA?

Who Must Conduct ICARA?

Overview of the ICARA Process

Roles and Responsibilities

Common Misconceptions and Pitfalls

Entities Covered (MIFIDPRU 7.1.1R: Investment firms, UK parent entities; exclusions for SNI vs. non-SNI)

Thresholds for Non-SNI Firms (MIFIDPRU 7.1.4R: AUM > £15bn, etc.; calculations with examples)

Currency Conversion and Data Requirements (MIFIDPRU 7.1.7R: Using Bank of England rates)

Application at Individual vs. Group Level (MIFIDPRU 7.1.3R table; MIFIDPRU 7.9 for groups)

Scope Assessment Checklist (Firm classification calculator)

Robust Governance Requirements (MIFIDPRU 7.2.1R: Clear structure, segregation of duties)

Factors to Consider (MIFIDPRU 7.2.2G: Size, complexity, client types, IT systems)

Proportionality Principle (Tailoring to firm size; examples for small vs. large firms)

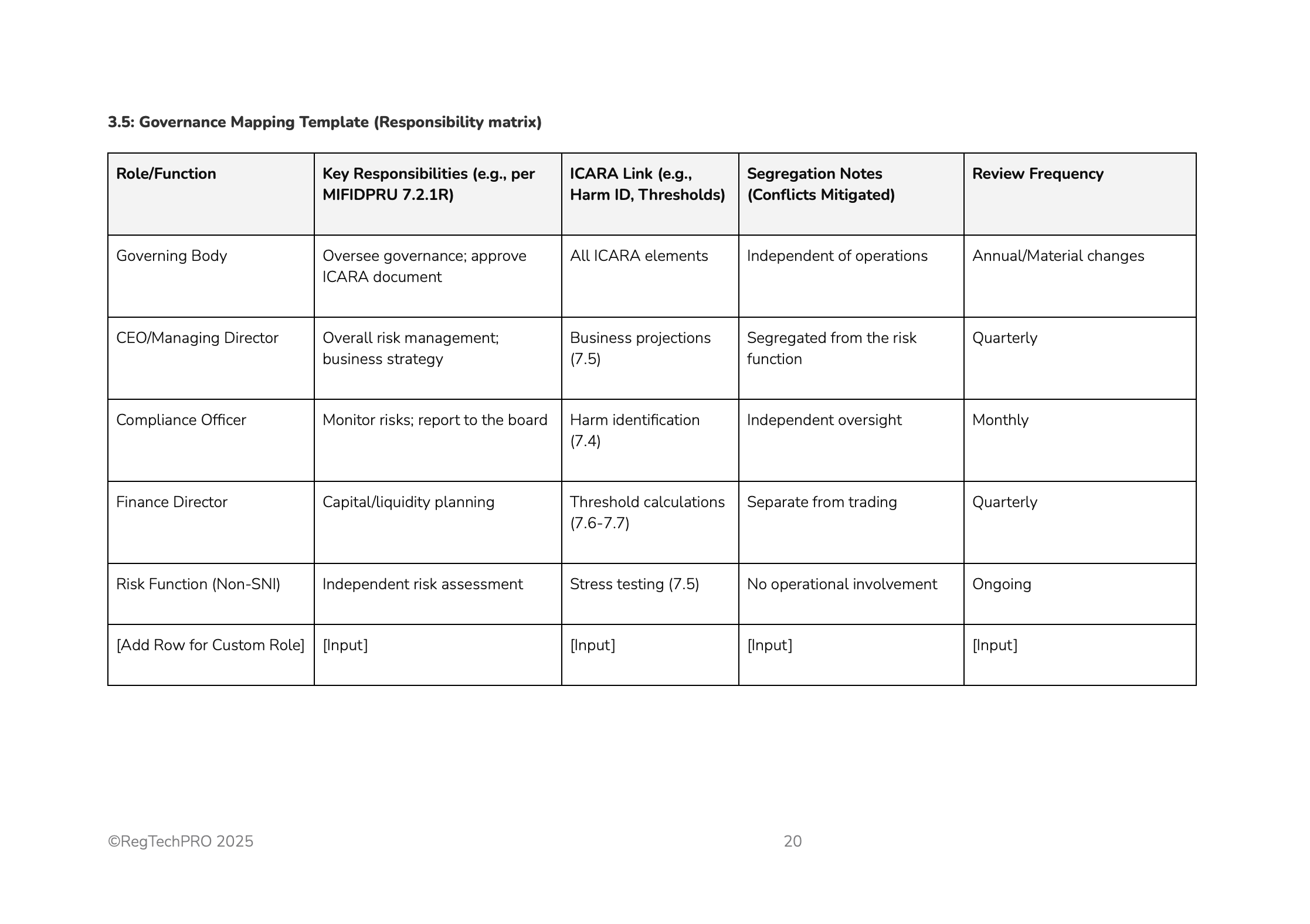

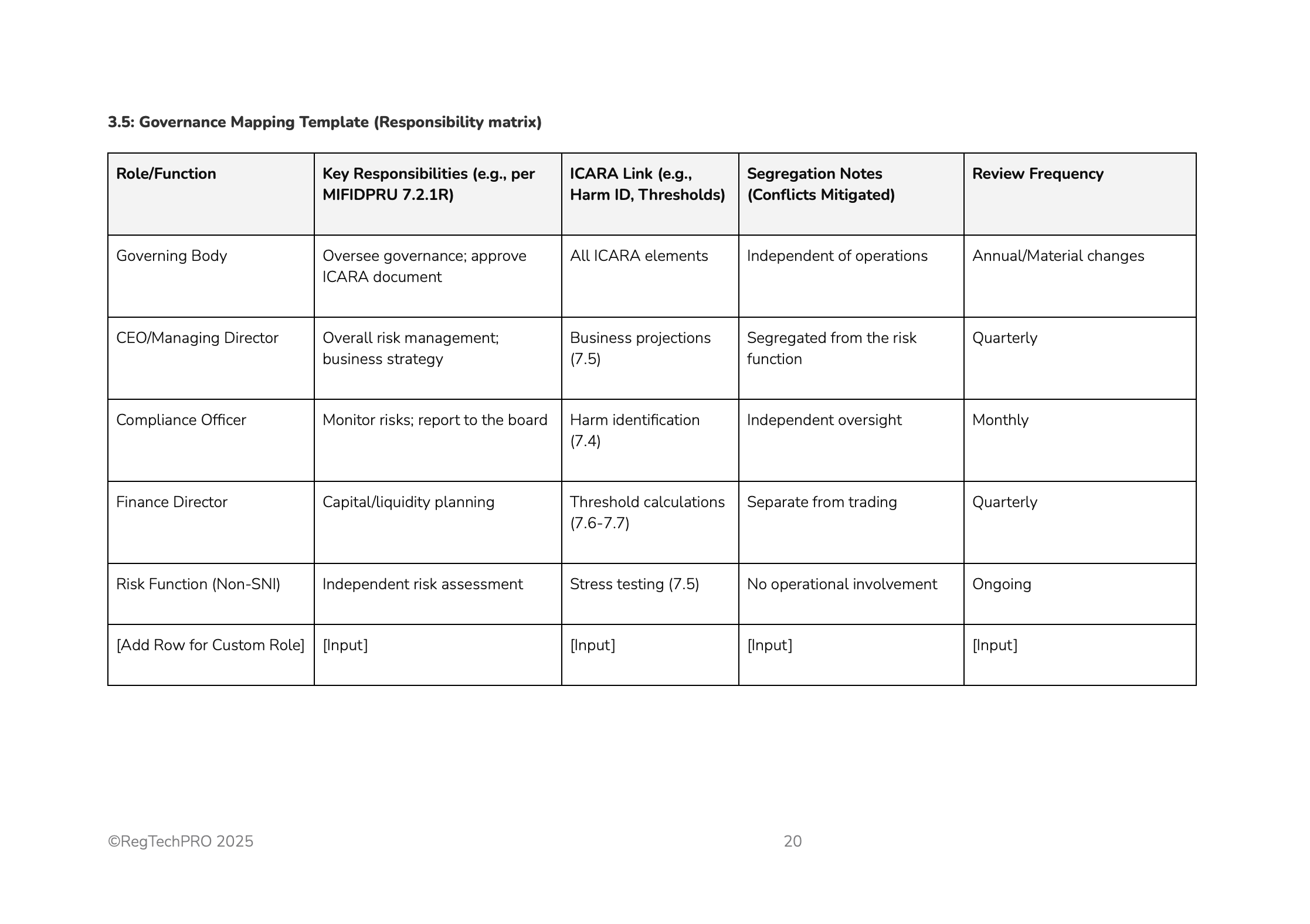

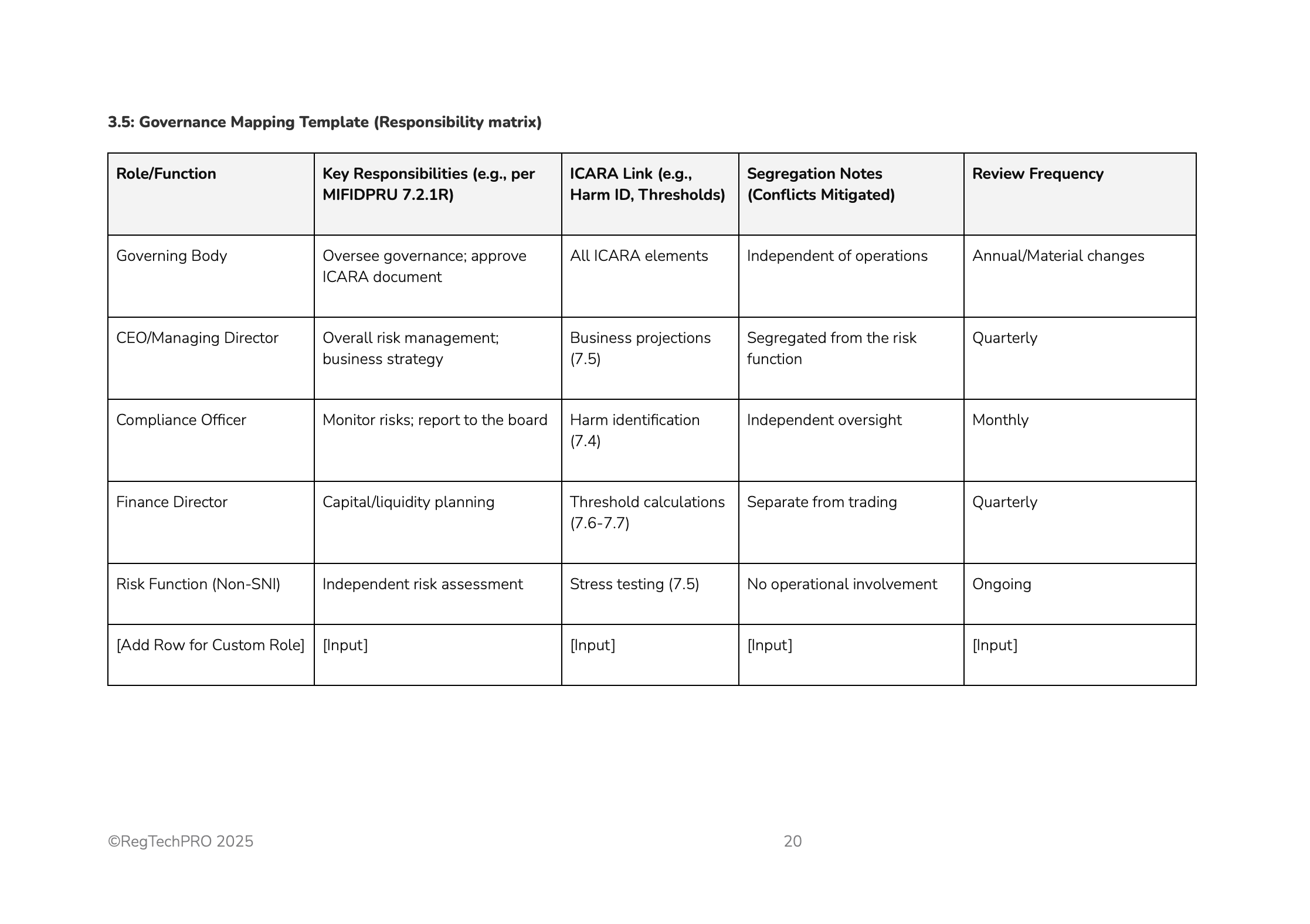

Governance Mapping Template (Responsibility matrix)

Requirement for Non-SNI Firms (MIFIDPRU 7.2A.1R: Independent risk function)

Independence and Resources (MIFIDPRU 7.2A.2R: Separate from operations; adequate authority)

Responsibilities (MIFIDPRU 7.2A.3R: Risk identification, monitoring, reporting)

Risk Function Charter (Roles, reporting lines)

When Committees Are Required (MIFIDPRU 7.3.1R: Non-SNI firms above thresholds)

Risk Committee (Composition, responsibilities; MIFIDPRU 7.3.1R-7.3.2G)

Remuneration Committee (MIFIDPRU 7.3.3R: Link to SYSC 19G; independent members)

Nomination Committee (MIFIDPRU 7.3.5R: Succession planning)

Group-Level Committees (MIFIDPRU 7.3.7R: Shared committees)

Notification Requirements (MIFIDPRU 7 Annexe 3R form)

Committee Terms of Reference (Sample charters)

ICARA Process Overview and Baseline Obligations

Overall Financial Adequacy Rule (OFAR) (MIFIDPRU 7.4.7R: Threshold requirements explained)

Proportionality in Assessments (MIFIDPRU 7.4.15G: Tailored to firm risks)

ICARA Overview Dashboard (Summary of thresholds, harms)

Identifying and Assessing Potential Harms

Capital and Liquidity Planning

Capital Planning (Own funds threshold; link to K-factors)

Liquidity Planning (Liquid assets threshold; core vs. non-core assets)

Financial Projections Template (Excel-style cash flow, balance sheet forecasts)

Stress Testing and Scenario Analysis

Forward-Looking Stress Tests (MIFIDPRU 7.5.2R(5): Severe but plausible scenarios)

Reverse Stress Testing (MIFIDPRU 7.5.5G: Breaking point analysis)

Scenario Design (MIFIDPRU 7 Annexe 1: Economic downturns, operational failures)

Stress Test Workbook (Scenarios, impacts on capital/liquidity)

Wind-Down Planning

Wind-Down Plan Template (Triggers, timelines, costs)

Recovery Actions (MIFIDPRU 7.5.6R: Early warning indicators, actions)

Recovery Plan Matrix (Actions, triggers, feasibility)

Own Funds Threshold Requirement (MIFIDPRU 7.6.2R: Higher of PMR/FOR + additional harms)

Own Funds Calculator (Breakdown, thresholds)

Assessing and Monitoring Adequacy of Liquid Assets

Liquid Assets Threshold Requirement (MIFIDPRU 7.7.2R: Basic + additional)

Core and Non-Core Liquid Assets (MIFIDPRU 7.7.8R-7.7.12G: Definitions, haircuts)

Liquid Assets Calculator (Holdings, thresholds, haircuts table)

Reviewing and Documenting the ICARA Process

ICARA for Firms in Groups

FCA's Approach (MIFIDPRU 7.10.1G: Review of ICARA adequacy)

Preparing for SREP (Documentation tips)

SREP Readiness Checklist

Full ICARA Template Compilation (Integrated workbook)

The 71-page ICARA Manual & Template document is an FCA-aligned guide for managing capital and liquidity risks under MIFIDPRU. Built on FG20/1, MIFIDPRU 7, and 2025 updates, it ensures robust financial adequacy, mitigating harms to clients, markets, and firms.

It details processes for risk assessments, stress testing, and wind-down planning, with customisable templates like MIF007 forms and K-factor calculators. Supporting SMCR accountability, FCA audits, and regulatory reporting, it strengthens financial resilience and compliance.

Includes:

What is ICARA?

Who Must Conduct ICARA?

Overview of the ICARA Process

Roles and Responsibilities

Common Misconceptions and Pitfalls

Entities Covered (MIFIDPRU 7.1.1R: Investment firms, UK parent entities; exclusions for SNI vs. non-SNI)

Thresholds for Non-SNI Firms (MIFIDPRU 7.1.4R: AUM > £15bn, etc.; calculations with examples)

Currency Conversion and Data Requirements (MIFIDPRU 7.1.7R: Using Bank of England rates)

Application at Individual vs. Group Level (MIFIDPRU 7.1.3R table; MIFIDPRU 7.9 for groups)

Scope Assessment Checklist (Firm classification calculator)

Robust Governance Requirements (MIFIDPRU 7.2.1R: Clear structure, segregation of duties)

Factors to Consider (MIFIDPRU 7.2.2G: Size, complexity, client types, IT systems)

Proportionality Principle (Tailoring to firm size; examples for small vs. large firms)

Governance Mapping Template (Responsibility matrix)

Requirement for Non-SNI Firms (MIFIDPRU 7.2A.1R: Independent risk function)

Independence and Resources (MIFIDPRU 7.2A.2R: Separate from operations; adequate authority)

Responsibilities (MIFIDPRU 7.2A.3R: Risk identification, monitoring, reporting)

Risk Function Charter (Roles, reporting lines)

When Committees Are Required (MIFIDPRU 7.3.1R: Non-SNI firms above thresholds)

Risk Committee (Composition, responsibilities; MIFIDPRU 7.3.1R-7.3.2G)

Remuneration Committee (MIFIDPRU 7.3.3R: Link to SYSC 19G; independent members)

Nomination Committee (MIFIDPRU 7.3.5R: Succession planning)

Group-Level Committees (MIFIDPRU 7.3.7R: Shared committees)

Notification Requirements (MIFIDPRU 7 Annexe 3R form)

Committee Terms of Reference (Sample charters)

ICARA Process Overview and Baseline Obligations

Overall Financial Adequacy Rule (OFAR) (MIFIDPRU 7.4.7R: Threshold requirements explained)

Proportionality in Assessments (MIFIDPRU 7.4.15G: Tailored to firm risks)

ICARA Overview Dashboard (Summary of thresholds, harms)

Identifying and Assessing Potential Harms

Capital and Liquidity Planning

Capital Planning (Own funds threshold; link to K-factors)

Liquidity Planning (Liquid assets threshold; core vs. non-core assets)

Financial Projections Template (Excel-style cash flow, balance sheet forecasts)

Stress Testing and Scenario Analysis

Forward-Looking Stress Tests (MIFIDPRU 7.5.2R(5): Severe but plausible scenarios)

Reverse Stress Testing (MIFIDPRU 7.5.5G: Breaking point analysis)

Scenario Design (MIFIDPRU 7 Annexe 1: Economic downturns, operational failures)

Stress Test Workbook (Scenarios, impacts on capital/liquidity)

Wind-Down Planning

Wind-Down Plan Template (Triggers, timelines, costs)

Recovery Actions (MIFIDPRU 7.5.6R: Early warning indicators, actions)

Recovery Plan Matrix (Actions, triggers, feasibility)

Own Funds Threshold Requirement (MIFIDPRU 7.6.2R: Higher of PMR/FOR + additional harms)

Own Funds Calculator (Breakdown, thresholds)

Assessing and Monitoring Adequacy of Liquid Assets

Liquid Assets Threshold Requirement (MIFIDPRU 7.7.2R: Basic + additional)

Core and Non-Core Liquid Assets (MIFIDPRU 7.7.8R-7.7.12G: Definitions, haircuts)

Liquid Assets Calculator (Holdings, thresholds, haircuts table)

Reviewing and Documenting the ICARA Process

ICARA for Firms in Groups

FCA's Approach (MIFIDPRU 7.10.1G: Review of ICARA adequacy)

Preparing for SREP (Documentation tips)

SREP Readiness Checklist

Full ICARA Template Compilation (Integrated workbook)