Image 1 of 3

Image 1 of 3

Image 2 of 3

Image 2 of 3

Image 3 of 3

Image 3 of 3

The Complete Handbook Guide to ICOBS

The 179-page The Complete Handbook Guide to ICOBS is an FCA-aligned resource designed to ensure compliance with insurance distribution and contract regulations. Built on ICOBS, FSMA, and 2025 FCA updates, it supports fair treatment, transparency, and prompt claims handling in insurance activities.

It details processes for policy sales, underwriting, and claims management, with customisable templates for compliance records and audit checklists.

Includes:

Client Categorisation

Communications to Clients and Financial Promotions

Inducements

Record-Keeping

Acting Honestly, Fairly and Professionally, Exclusion of Liability, Conditions and Warranties

Distribution of Connected Contracts Through Exempt Persons

Customers in Financial Difficulty

Distance Marketing

E-Commerce

Guidance on the UK Provisions Implementing the Distance Marketing Directive

Distance Marketing Information

Abbreviated Distance Marketing Information

General Requirements for Insurance Intermediaries and Insurers

Means of Communication with Customers

Additional Requirements for Protection Policies for Insurance Intermediaries and Insurers

Remuneration Disclosure

Commission Disclosure for Commercial Customers

Commission Disclosure for Pure Protection Contracts Sold with Retail Investment Products

Identifying client needs and advising

Demands and Needs

Advised Sales

Producing and Providing Product Information

Pre-Contract Information: General Insurance Contracts

Pre-and Post-Contract Information: Pure Protection Contracts

Renewals

Means of Communication

Responsibilities of Insurers and Insurance Intermediaries in Certain Situations

Providing Product Information by way of a Standardised Insurance Information Document (IPID)

Guaranteed Asset Protection (GAP) Contracts

Optional Additional Products

Cross-selling

Travel Insurance and Medical Conditions

Retail Premium Finance: Disclosure and Remuneration

Cancellation of Automatic Renewal

Disclosure requirements for multi-occupancy buildings Insurance

Home insurance and motor insurance pricing

Setting Renewal Prices

Assumptions Regarding the Channel Used by the Customer

Incentives

New Business Discounts

Calculating the Equivalent New Business Price: Missing Information

Calculating the Equivalent New Business Price – Information Acquired During the Term of the Customer’s Current Policy

Changes to Contractual Parties

Subscription Policies

Closed Books

Intermediaries’ Remuneration and Involvement in Setting Price

Firms’ Assurance Of Customer Outcomes

Notifications to the FCA

Sales Practices: Renewal Pricing and Fair Treatment of Customers

Policies and Procedures

Attestation Requirements

The Right to Cancel

Claims handling

Motor Vehicle Liability Insurers

Employers’ Liability Insurance

The 179-page The Complete Handbook Guide to ICOBS is an FCA-aligned resource designed to ensure compliance with insurance distribution and contract regulations. Built on ICOBS, FSMA, and 2025 FCA updates, it supports fair treatment, transparency, and prompt claims handling in insurance activities.

It details processes for policy sales, underwriting, and claims management, with customisable templates for compliance records and audit checklists.

Includes:

Client Categorisation

Communications to Clients and Financial Promotions

Inducements

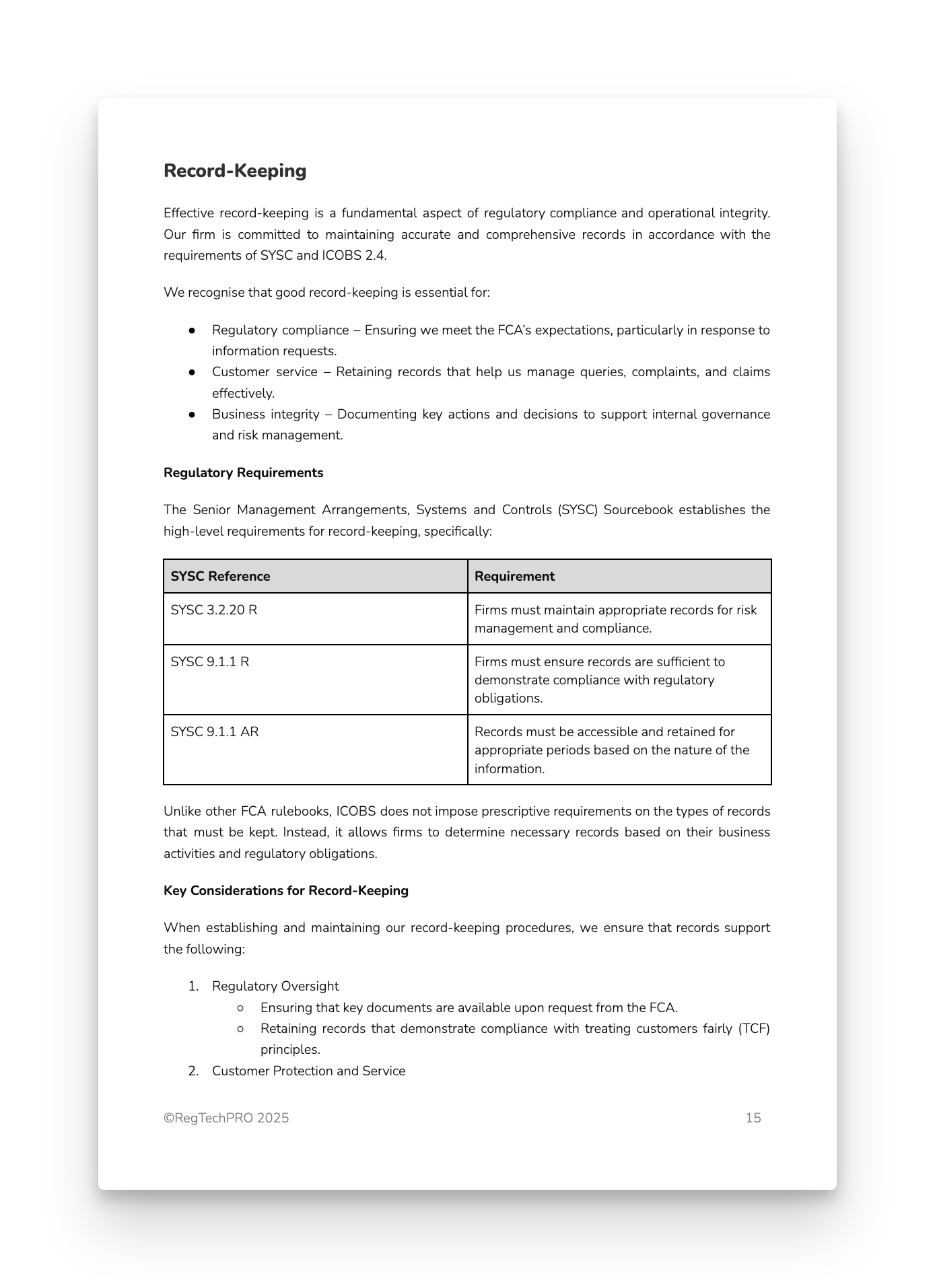

Record-Keeping

Acting Honestly, Fairly and Professionally, Exclusion of Liability, Conditions and Warranties

Distribution of Connected Contracts Through Exempt Persons

Customers in Financial Difficulty

Distance Marketing

E-Commerce

Guidance on the UK Provisions Implementing the Distance Marketing Directive

Distance Marketing Information

Abbreviated Distance Marketing Information

General Requirements for Insurance Intermediaries and Insurers

Means of Communication with Customers

Additional Requirements for Protection Policies for Insurance Intermediaries and Insurers

Remuneration Disclosure

Commission Disclosure for Commercial Customers

Commission Disclosure for Pure Protection Contracts Sold with Retail Investment Products

Identifying client needs and advising

Demands and Needs

Advised Sales

Producing and Providing Product Information

Pre-Contract Information: General Insurance Contracts

Pre-and Post-Contract Information: Pure Protection Contracts

Renewals

Means of Communication

Responsibilities of Insurers and Insurance Intermediaries in Certain Situations

Providing Product Information by way of a Standardised Insurance Information Document (IPID)

Guaranteed Asset Protection (GAP) Contracts

Optional Additional Products

Cross-selling

Travel Insurance and Medical Conditions

Retail Premium Finance: Disclosure and Remuneration

Cancellation of Automatic Renewal

Disclosure requirements for multi-occupancy buildings Insurance

Home insurance and motor insurance pricing

Setting Renewal Prices

Assumptions Regarding the Channel Used by the Customer

Incentives

New Business Discounts

Calculating the Equivalent New Business Price: Missing Information

Calculating the Equivalent New Business Price – Information Acquired During the Term of the Customer’s Current Policy

Changes to Contractual Parties

Subscription Policies

Closed Books

Intermediaries’ Remuneration and Involvement in Setting Price

Firms’ Assurance Of Customer Outcomes

Notifications to the FCA

Sales Practices: Renewal Pricing and Fair Treatment of Customers

Policies and Procedures

Attestation Requirements

The Right to Cancel

Claims handling

Motor Vehicle Liability Insurers

Employers’ Liability Insurance