Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

Anti-Money Laundering Policy + Templates

The 106-page AML Policy + Templates is an FCA-aligned guide designed to prevent money laundering and terrorist financing in the financial services sector. Built on POCA, MLR 2017, FCA SYSC, and 2025 updates, it establishes a robust framework to detect and report financial crime, reducing risk exposure.

It details customer due diligence, transaction monitoring, and suspicious activity reporting, with customisable templates like KYC forms and training quizzes. Supporting SMCR accountability, FCA audits, and sanctions compliance, it ensures operational integrity and regulatory adherence.

Includes:

Role of the Board and Senior Management

Responsibilities of the Money Laundering Reporting Officer (MLRO)

AML/CFT Governance Structure

Oversight and Accountability

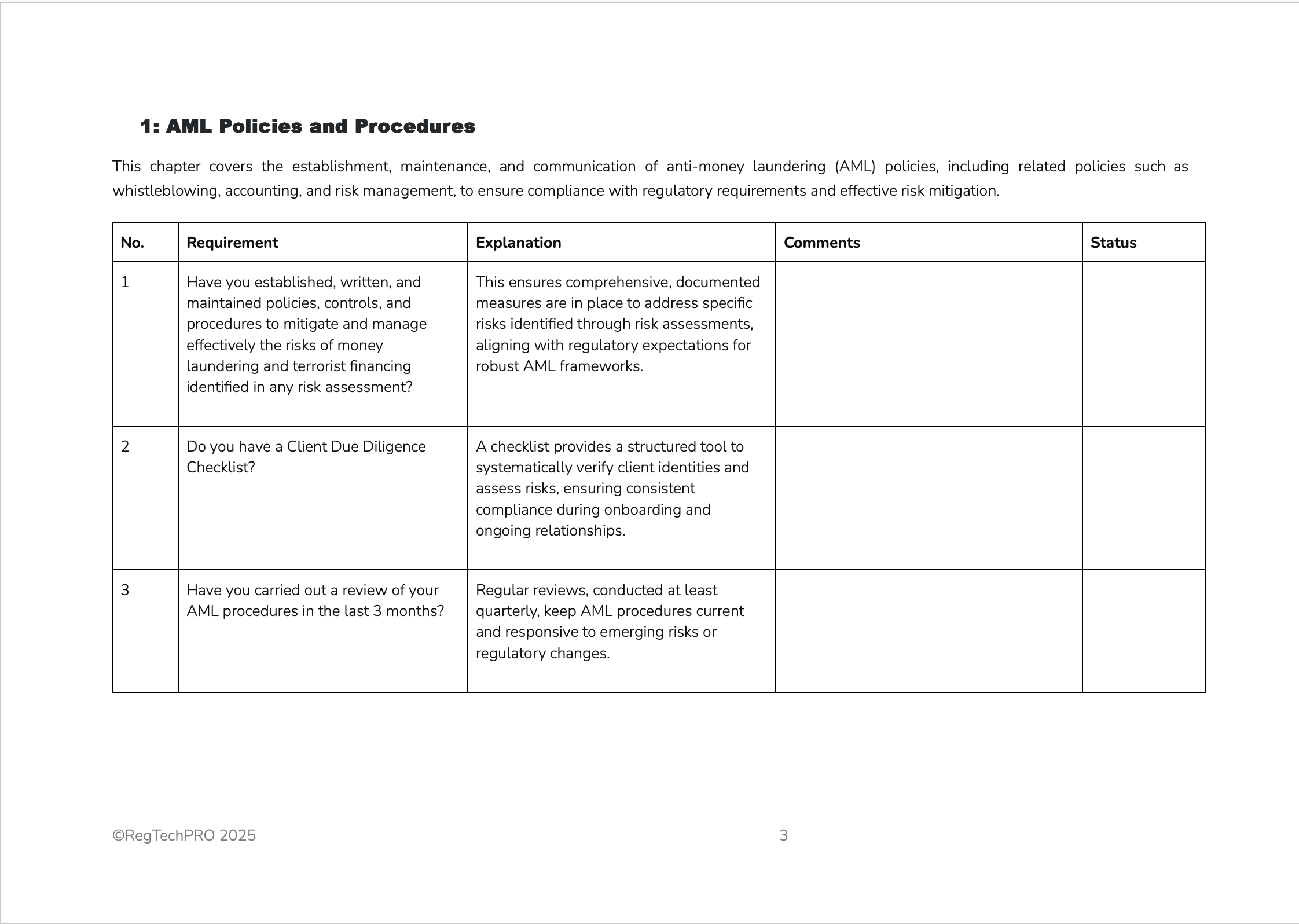

AML Policies and Procedures

Importance of a Risk-Based Approach

Conducting a Company-Wide Risk Assessment

Client Risk Assessment and Due Diligence

Customer Due Diligence (CDD)

EDD for High-Risk Customers

Simplified Due Diligence (SDD)

Suspicious Activity Reporting

Transaction Monitoring

Record Keeping and Documentation

Staff Training and Awareness

Internal Controls and Auditing

Annual MLRO Report to the Board

Reporting to the FCA and Other Regulators

Penalties for Non-Compliance

AML Considerations in Mergers and Acquisitions

Handling High-Risk Clients and Politically Exposed Persons (PEPs)

Cross-Border Transactions and International Clients

Use of Third-Party Providers and Outsourcing Risks

Anti-Bribery and Corruption Integration

Fraud Prevention and Detection

UK, EU, and OFAC Sanctions Regimes

Handling Sanctions Matches and False Positives

Emerging Risks and Regulatory Changes

Sample Policies and Procedures

Company-Wide AML Risk Assessment Template

Customer Risk Assessment Template

Product & Service Risk Assessment Template

Jurisdictional Risk Assessment Template

Suspicious Activity Report (SAR) Template

Annual MLRO Report Template

Internal Fraud Investigation Report Template

High-Risk Customer Review Report Template

AML Training Program Structure

Training Presentation Slides

Knowledge Check – AML Quiz

UK Regulatory Bodies and Authorities

International AML Guidelines and Standards

Industry Guidance and Best Practices

Sanctions and Watchlist Screening Tools

AML Training and Certification Programs

The 106-page AML Policy + Templates is an FCA-aligned guide designed to prevent money laundering and terrorist financing in the financial services sector. Built on POCA, MLR 2017, FCA SYSC, and 2025 updates, it establishes a robust framework to detect and report financial crime, reducing risk exposure.

It details customer due diligence, transaction monitoring, and suspicious activity reporting, with customisable templates like KYC forms and training quizzes. Supporting SMCR accountability, FCA audits, and sanctions compliance, it ensures operational integrity and regulatory adherence.

Includes:

Role of the Board and Senior Management

Responsibilities of the Money Laundering Reporting Officer (MLRO)

AML/CFT Governance Structure

Oversight and Accountability

AML Policies and Procedures

Importance of a Risk-Based Approach

Conducting a Company-Wide Risk Assessment

Client Risk Assessment and Due Diligence

Customer Due Diligence (CDD)

EDD for High-Risk Customers

Simplified Due Diligence (SDD)

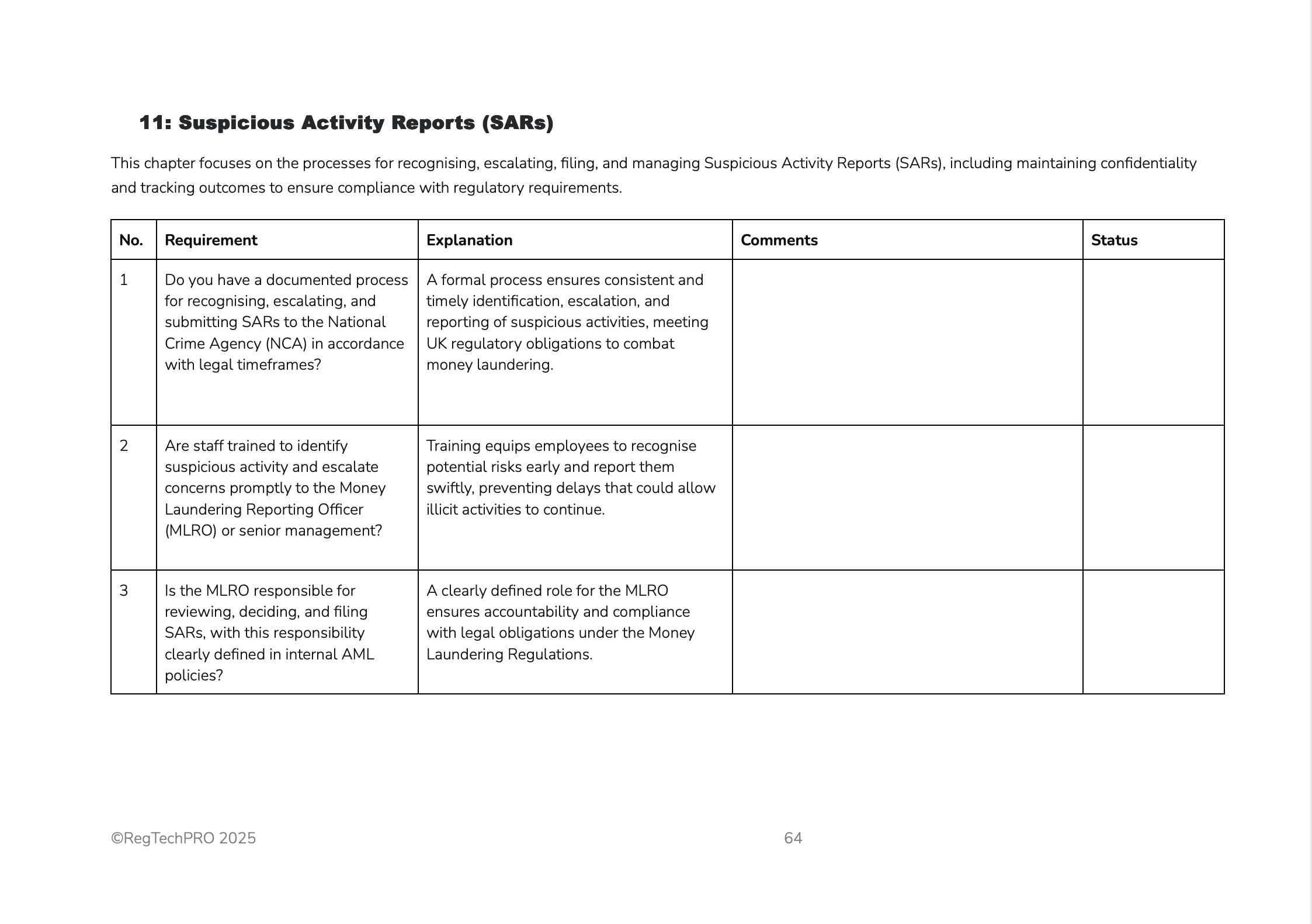

Suspicious Activity Reporting

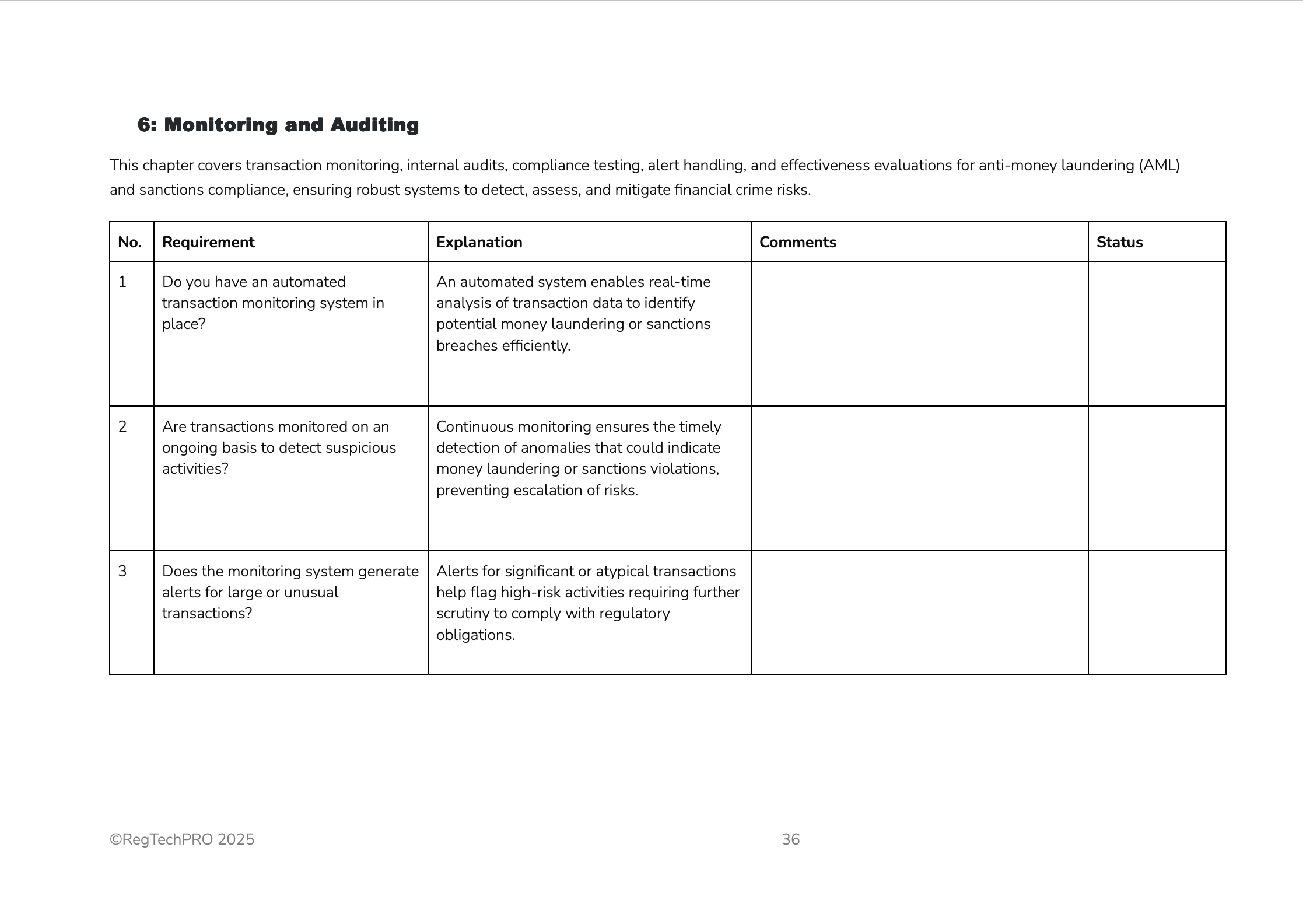

Transaction Monitoring

Record Keeping and Documentation

Staff Training and Awareness

Internal Controls and Auditing

Annual MLRO Report to the Board

Reporting to the FCA and Other Regulators

Penalties for Non-Compliance

AML Considerations in Mergers and Acquisitions

Handling High-Risk Clients and Politically Exposed Persons (PEPs)

Cross-Border Transactions and International Clients

Use of Third-Party Providers and Outsourcing Risks

Anti-Bribery and Corruption Integration

Fraud Prevention and Detection

UK, EU, and OFAC Sanctions Regimes

Handling Sanctions Matches and False Positives

Emerging Risks and Regulatory Changes

Sample Policies and Procedures

Company-Wide AML Risk Assessment Template

Customer Risk Assessment Template

Product & Service Risk Assessment Template

Jurisdictional Risk Assessment Template

Suspicious Activity Report (SAR) Template

Annual MLRO Report Template

Internal Fraud Investigation Report Template

High-Risk Customer Review Report Template

AML Training Program Structure

Training Presentation Slides

Knowledge Check – AML Quiz

UK Regulatory Bodies and Authorities

International AML Guidelines and Standards

Industry Guidance and Best Practices

Sanctions and Watchlist Screening Tools

AML Training and Certification Programs