Image 1 of 4

Image 1 of 4

Image 2 of 4

Image 2 of 4

Image 3 of 4

Image 3 of 4

Image 4 of 4

Image 4 of 4

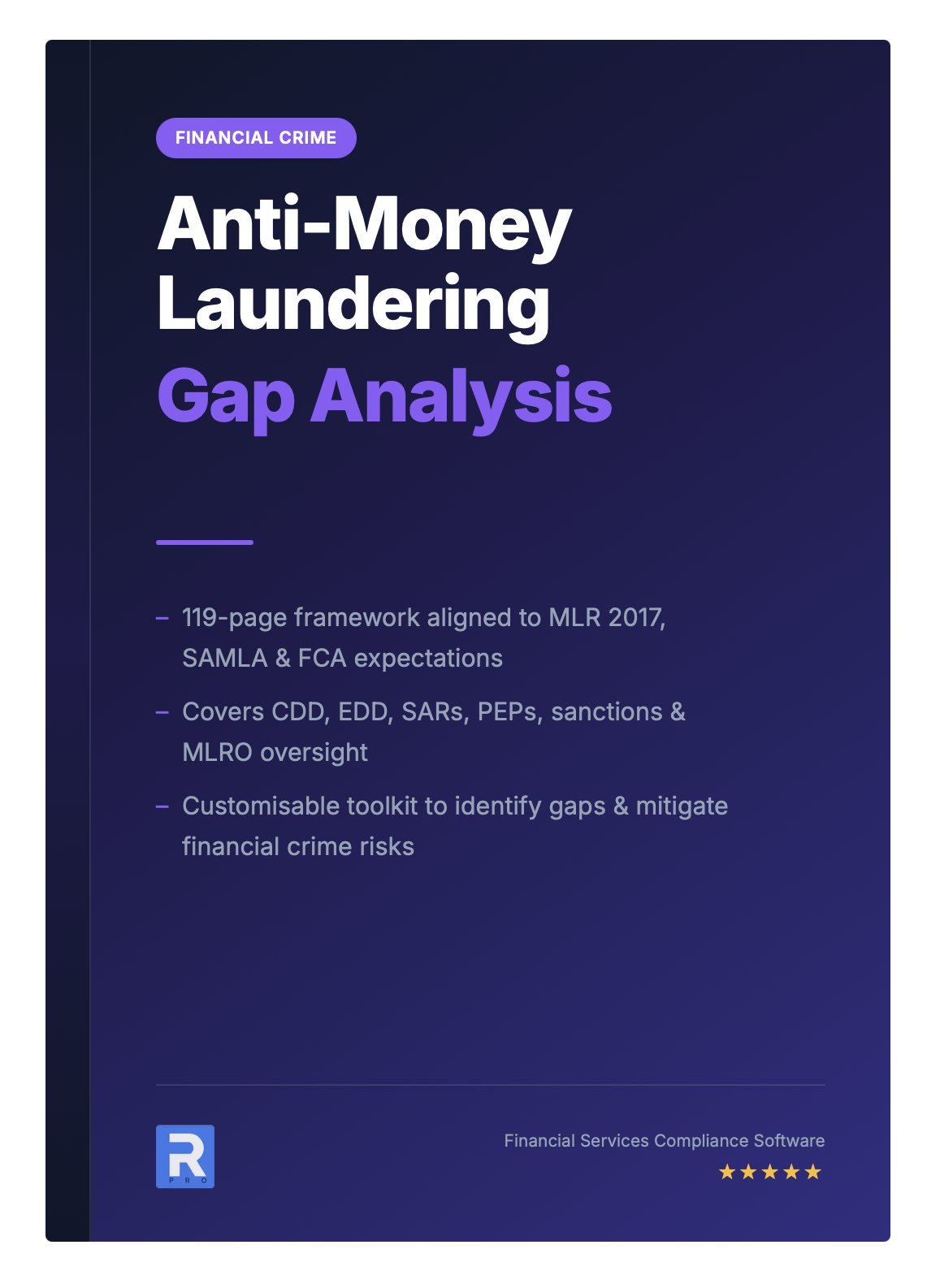

Anti-Money Laundering Gap Analysis Template

This comprehensive 119-page Anti-Money Laundering Gap Analysis Template provides a robust framework to ensure your organisation meets stringent UK regulatory requirements, including the Money Laundering Regulations 2017, the Sanctions and Anti-Money Laundering Act 2018 (SAMLA), and FCA expectations.

Designed to identify and address compliance gaps, this guide covers critical areas such as AML policies, MLRO oversight, staff training, customer due diligence (CDD), enhanced due diligence (EDD), suspicious activity reporting (SARs), and sanctions compliance.

By implementing this customisable toolkit, your organisation can mitigate risks of financial crime, avoid severe penalties such as fines or criminal sanctions, and strengthen governance, fostering trust with regulators, clients, and stakeholders while safeguarding against money laundering, terrorist financing, and reputational damage.

Covered Areas include:

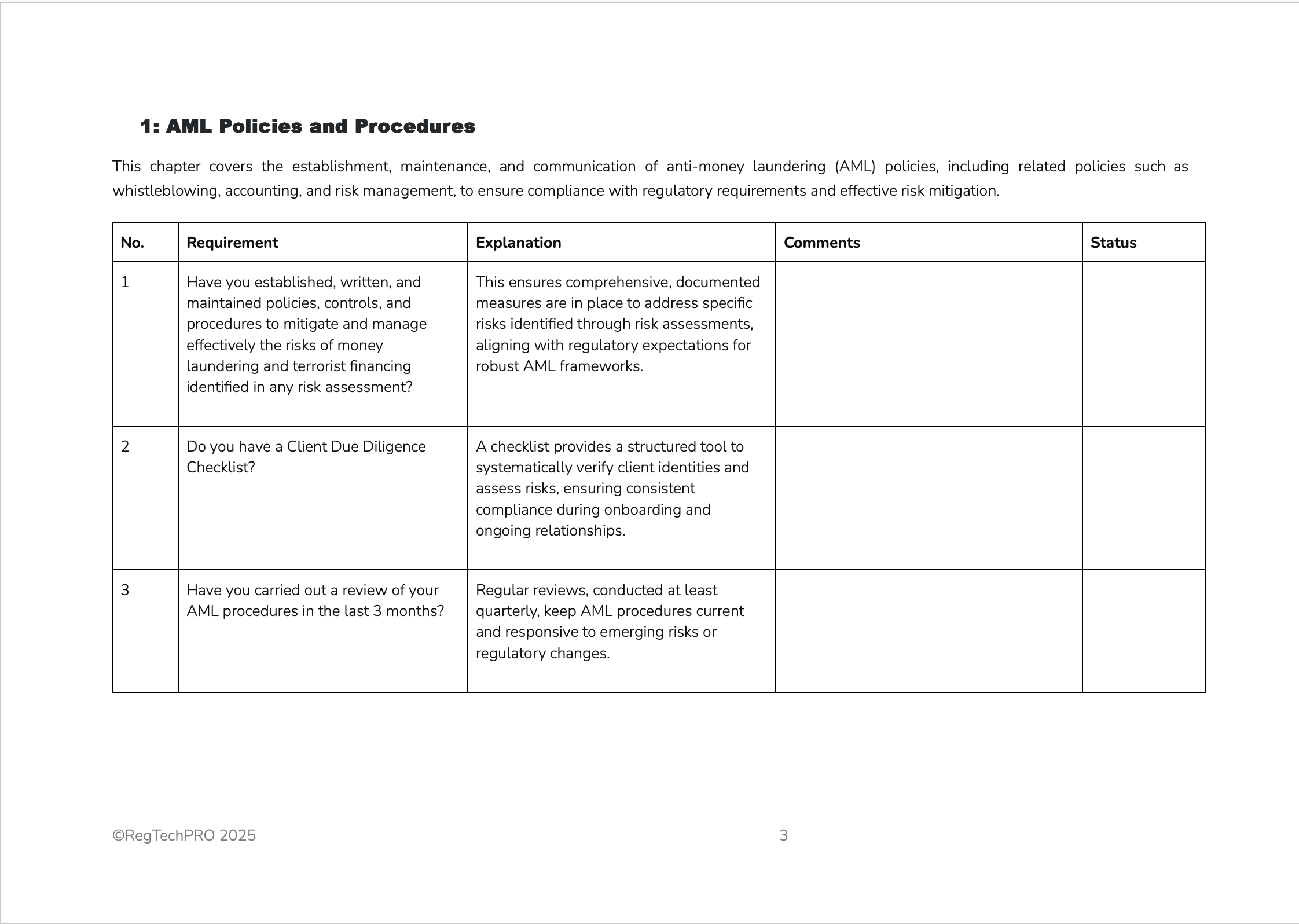

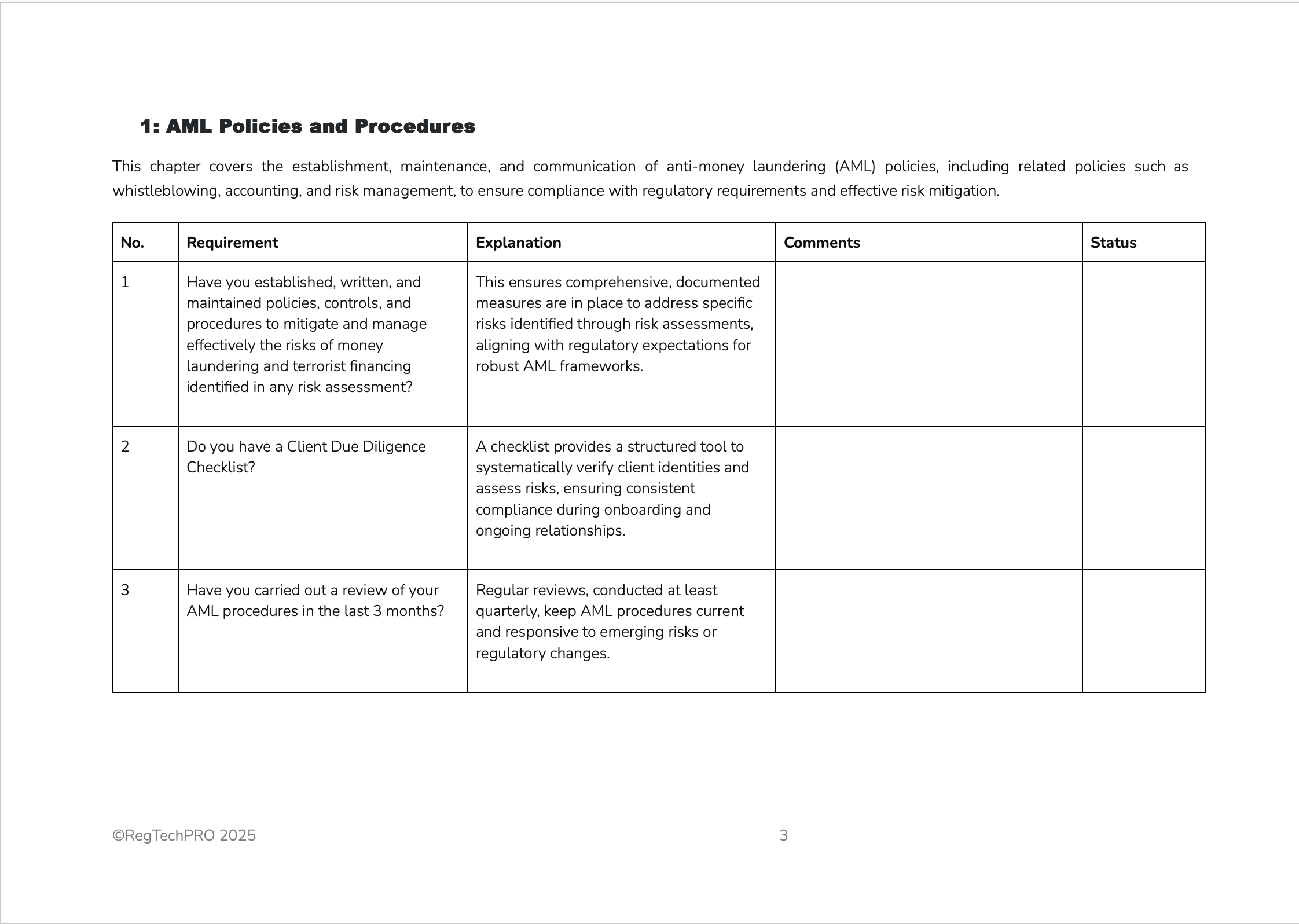

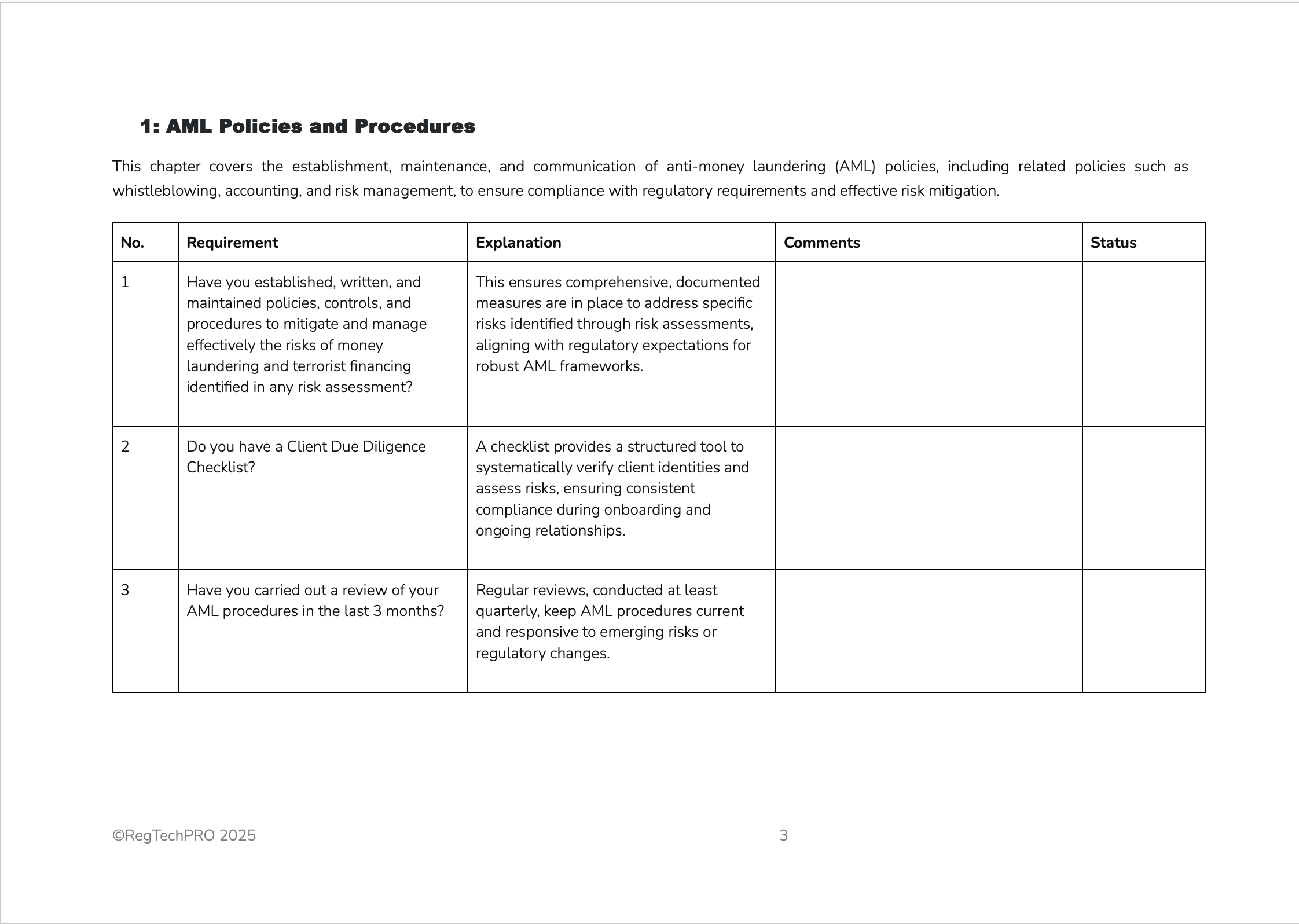

AML Policies and Procedures

MLRO/NO Appointment and Oversight

Staff Training and Awareness

Employee Screening and Recruitment

Risk Assessment and Management

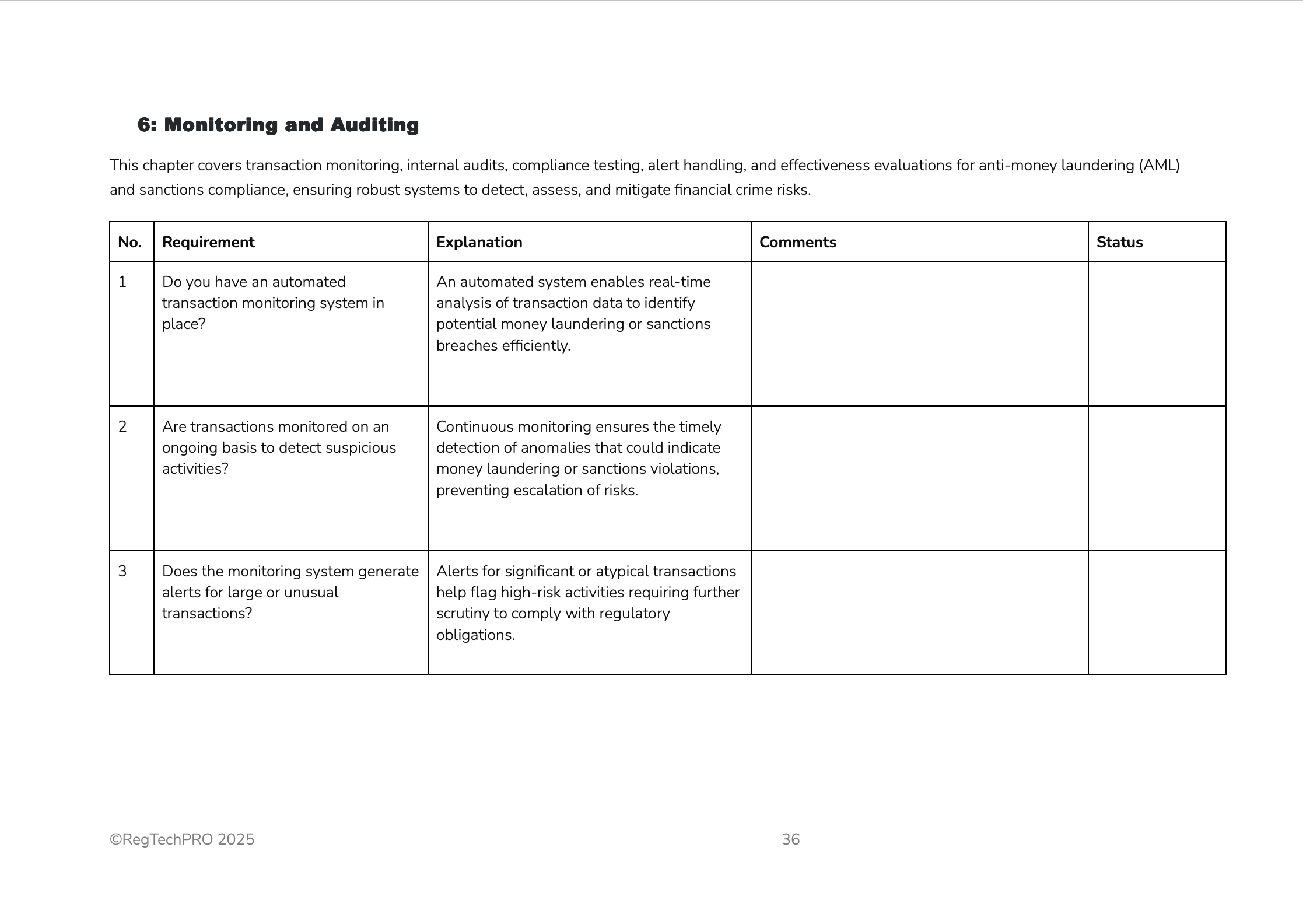

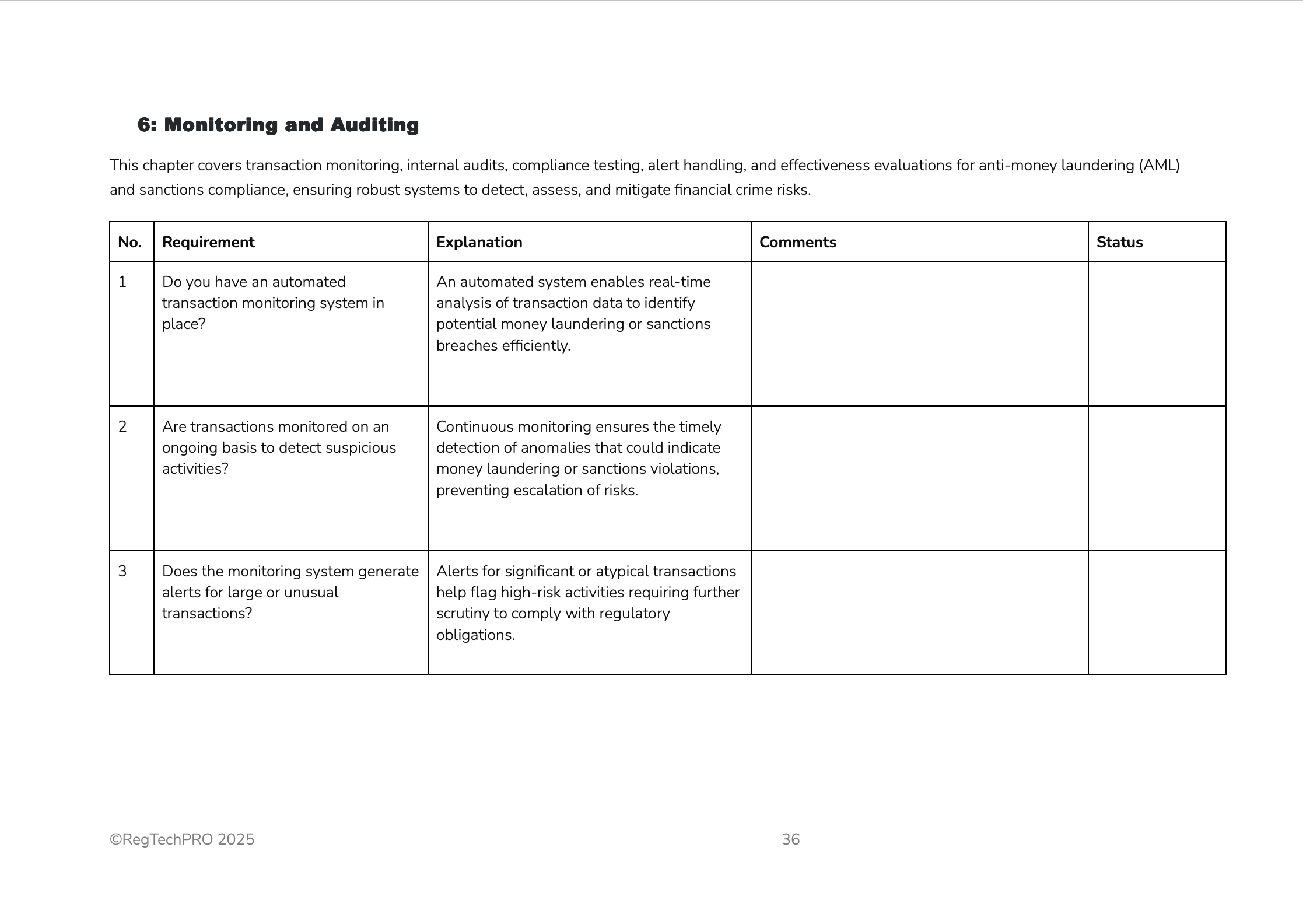

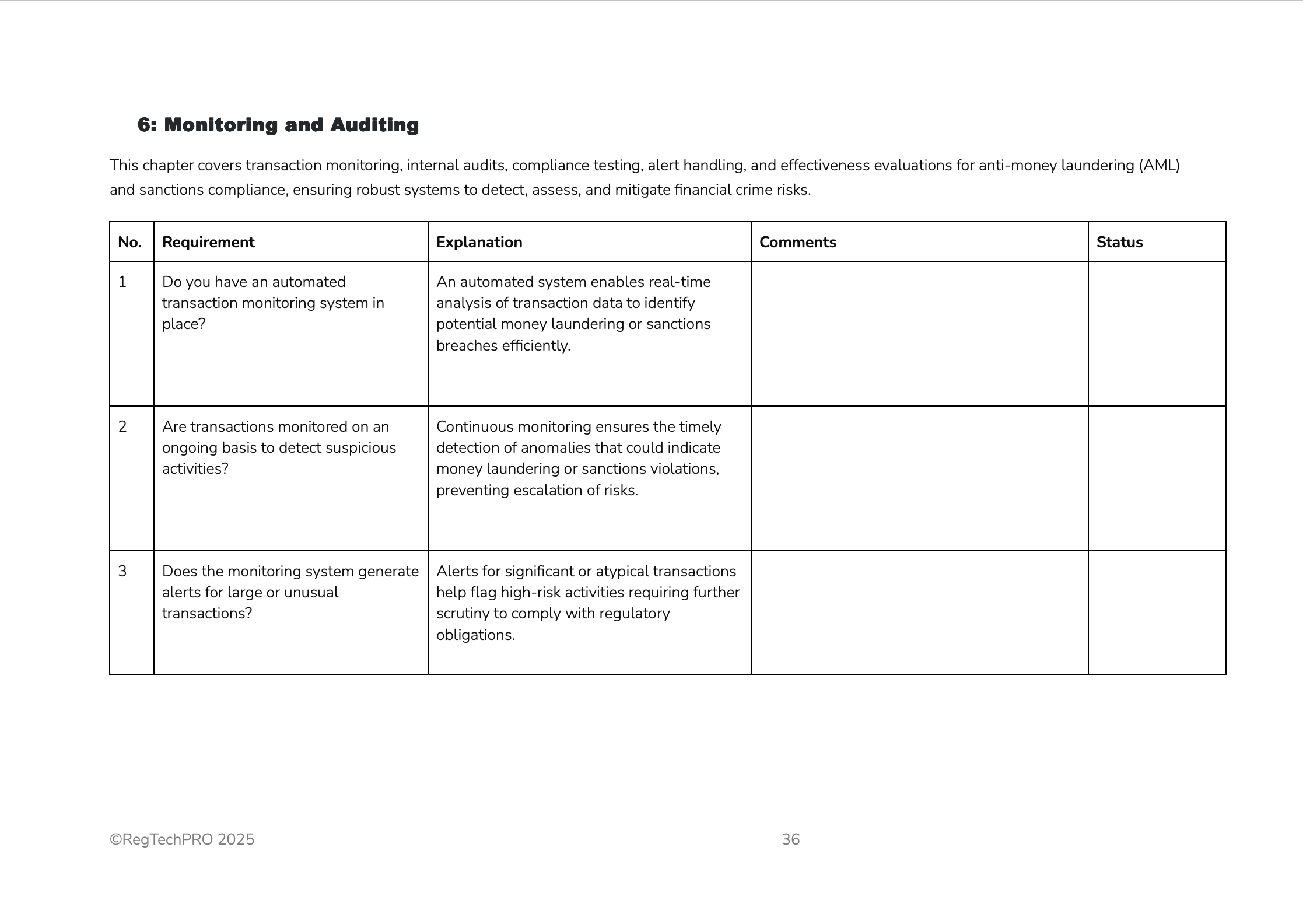

Monitoring and Auditing

Customer Due Diligence (CDD)

Enhanced Due Diligence (EDD)

Outsourcing and Third-Party Management

Record Keeping and Reporting

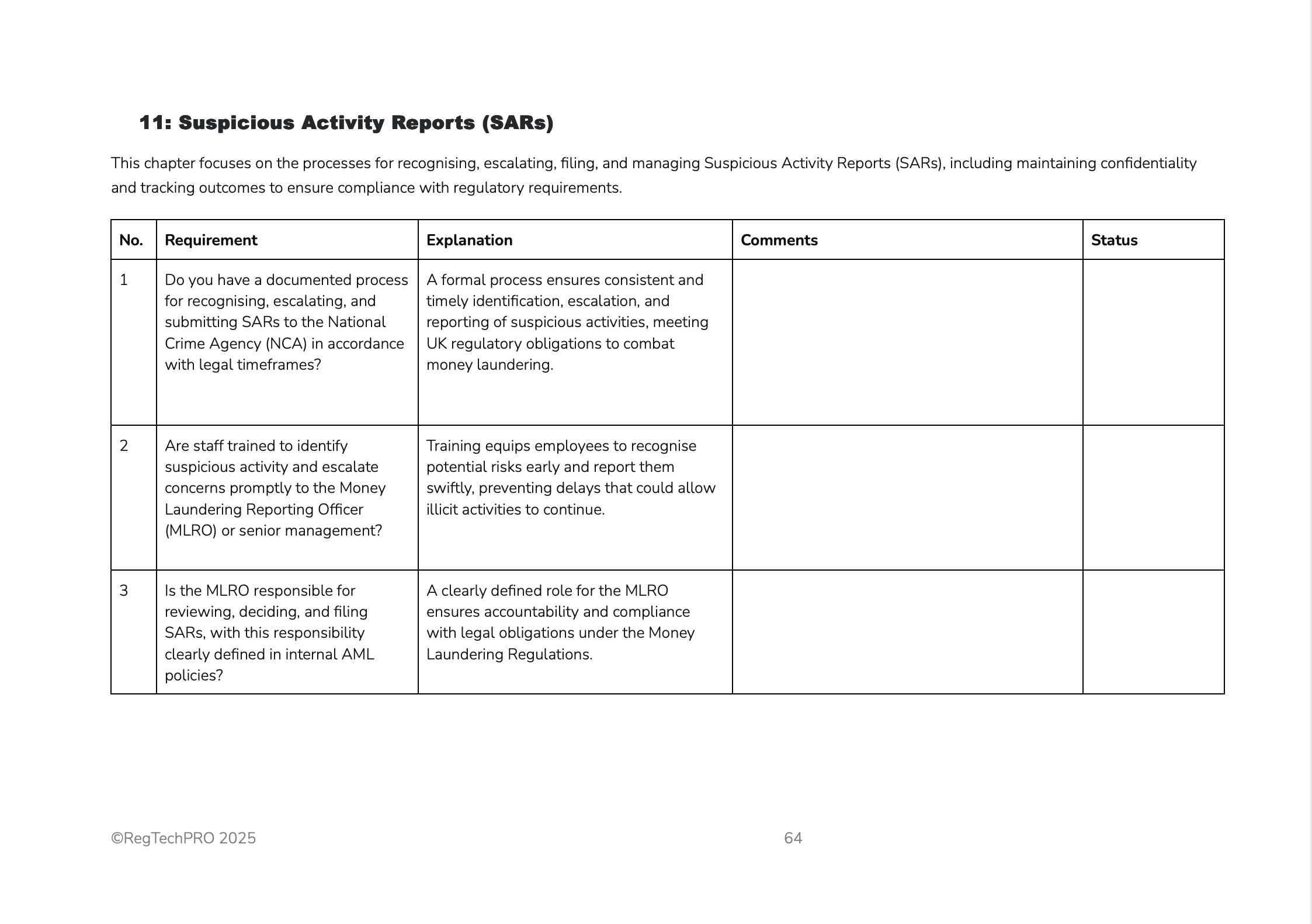

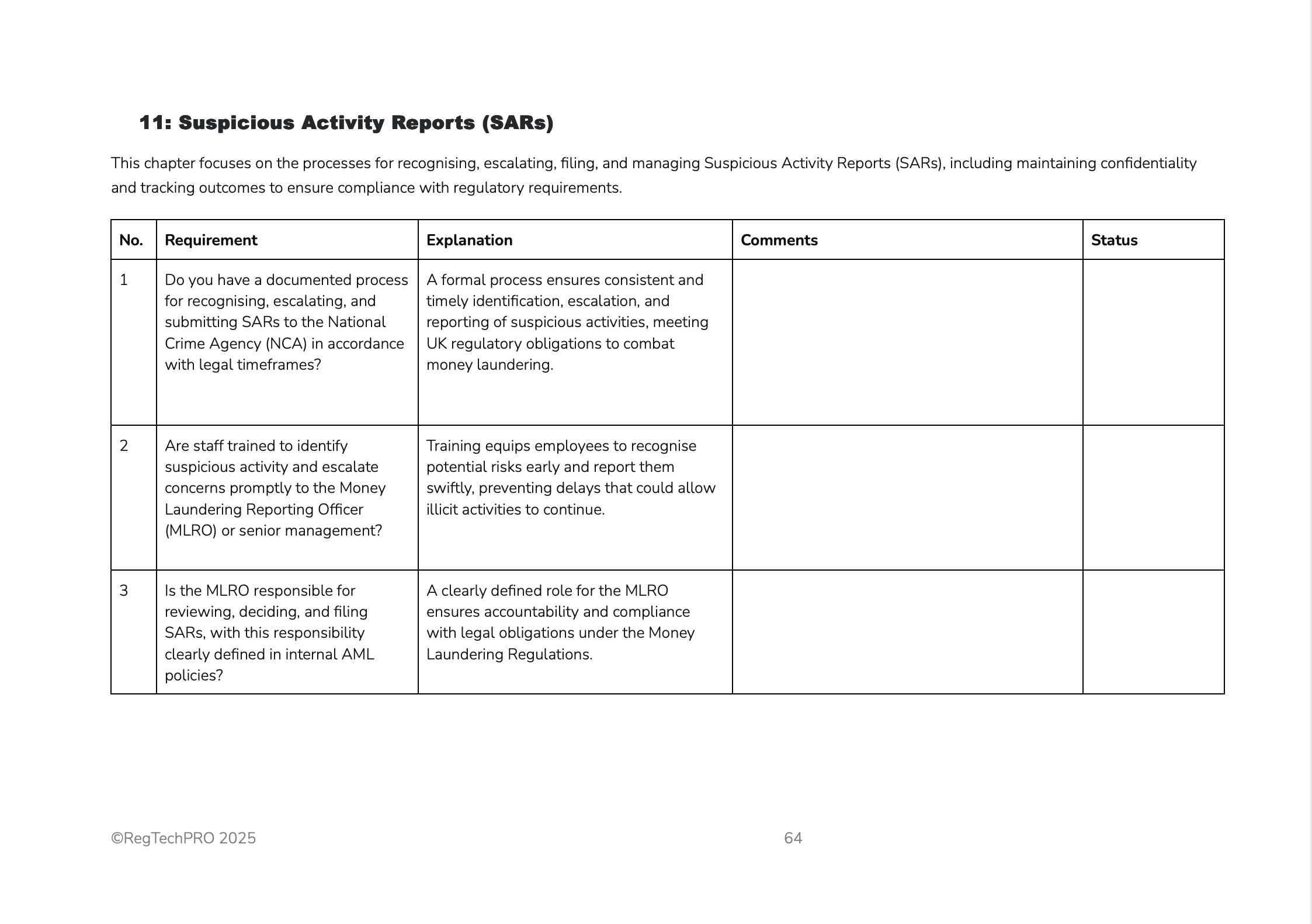

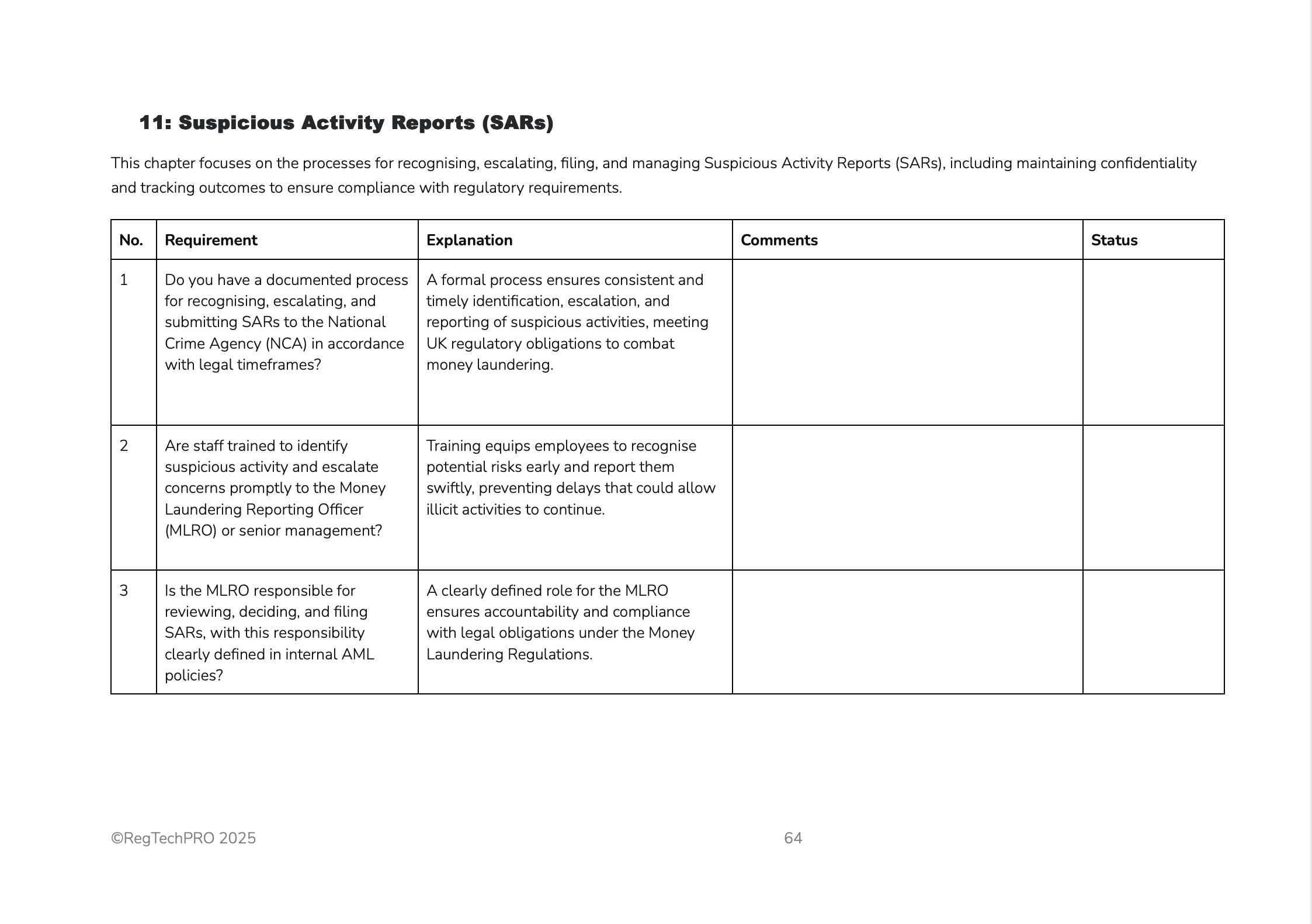

Suspicious Activity Reports (SARs)

Politically Exposed Persons (PEPs)

Anti-Bribery & Corruption (ABC)

Sanctions Compliance

This comprehensive 119-page Anti-Money Laundering Gap Analysis Template provides a robust framework to ensure your organisation meets stringent UK regulatory requirements, including the Money Laundering Regulations 2017, the Sanctions and Anti-Money Laundering Act 2018 (SAMLA), and FCA expectations.

Designed to identify and address compliance gaps, this guide covers critical areas such as AML policies, MLRO oversight, staff training, customer due diligence (CDD), enhanced due diligence (EDD), suspicious activity reporting (SARs), and sanctions compliance.

By implementing this customisable toolkit, your organisation can mitigate risks of financial crime, avoid severe penalties such as fines or criminal sanctions, and strengthen governance, fostering trust with regulators, clients, and stakeholders while safeguarding against money laundering, terrorist financing, and reputational damage.

Covered Areas include:

AML Policies and Procedures

MLRO/NO Appointment and Oversight

Staff Training and Awareness

Employee Screening and Recruitment

Risk Assessment and Management

Monitoring and Auditing

Customer Due Diligence (CDD)

Enhanced Due Diligence (EDD)

Outsourcing and Third-Party Management

Record Keeping and Reporting

Suspicious Activity Reports (SARs)

Politically Exposed Persons (PEPs)

Anti-Bribery & Corruption (ABC)

Sanctions Compliance