Image 1 of 6

Image 1 of 6

Image 2 of 6

Image 2 of 6

Image 3 of 6

Image 3 of 6

Image 4 of 6

Image 4 of 6

Image 5 of 6

Image 5 of 6

Image 6 of 6

Image 6 of 6

Non-MiFID Performance Communications for Investment Promotions

Length: 16 Pages

Applies to: Investment Firms

Fully Customisable COBS 4.6 Guide – Past, Simulated Past & Future Performance (Non-MiFID Provisions)

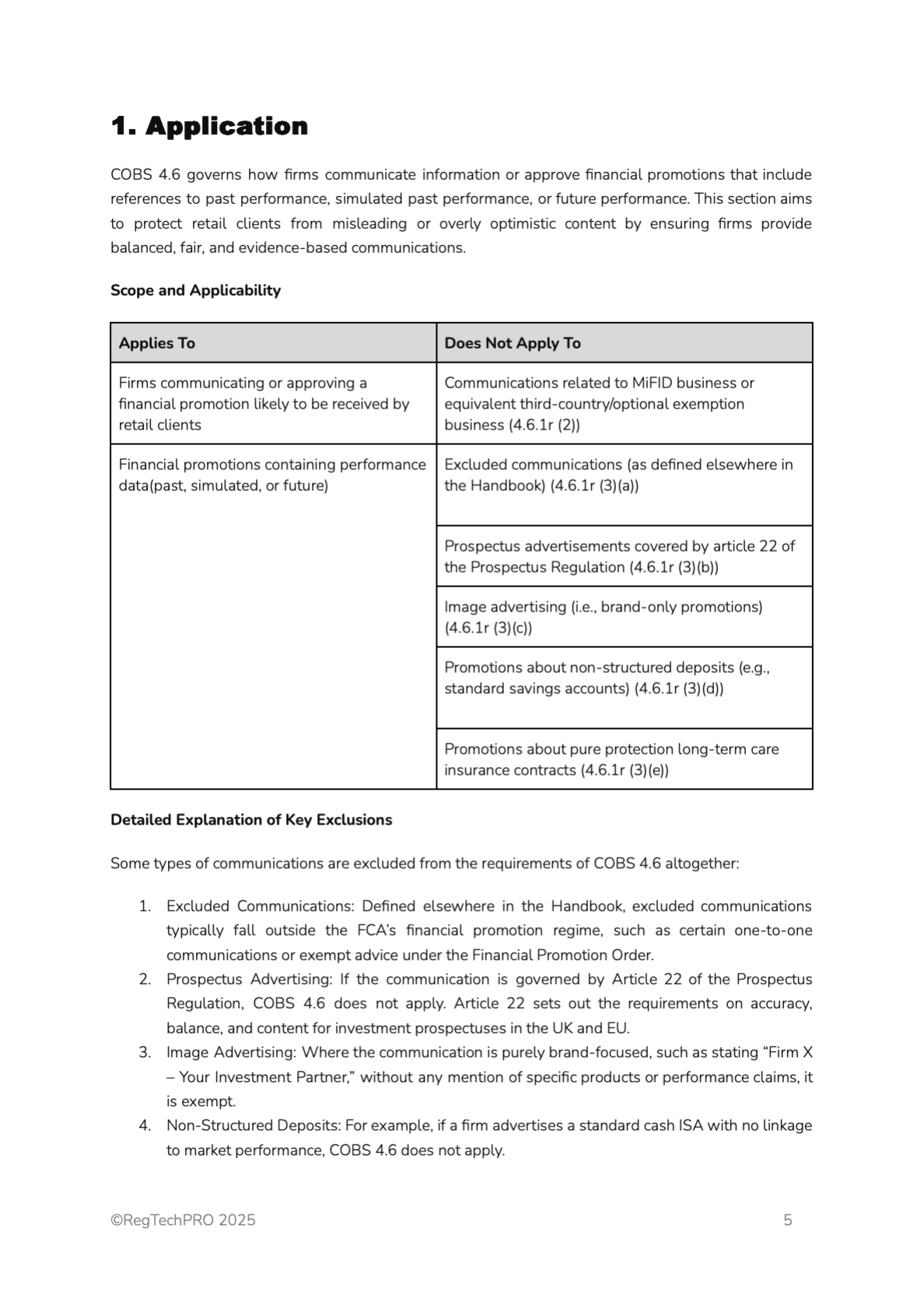

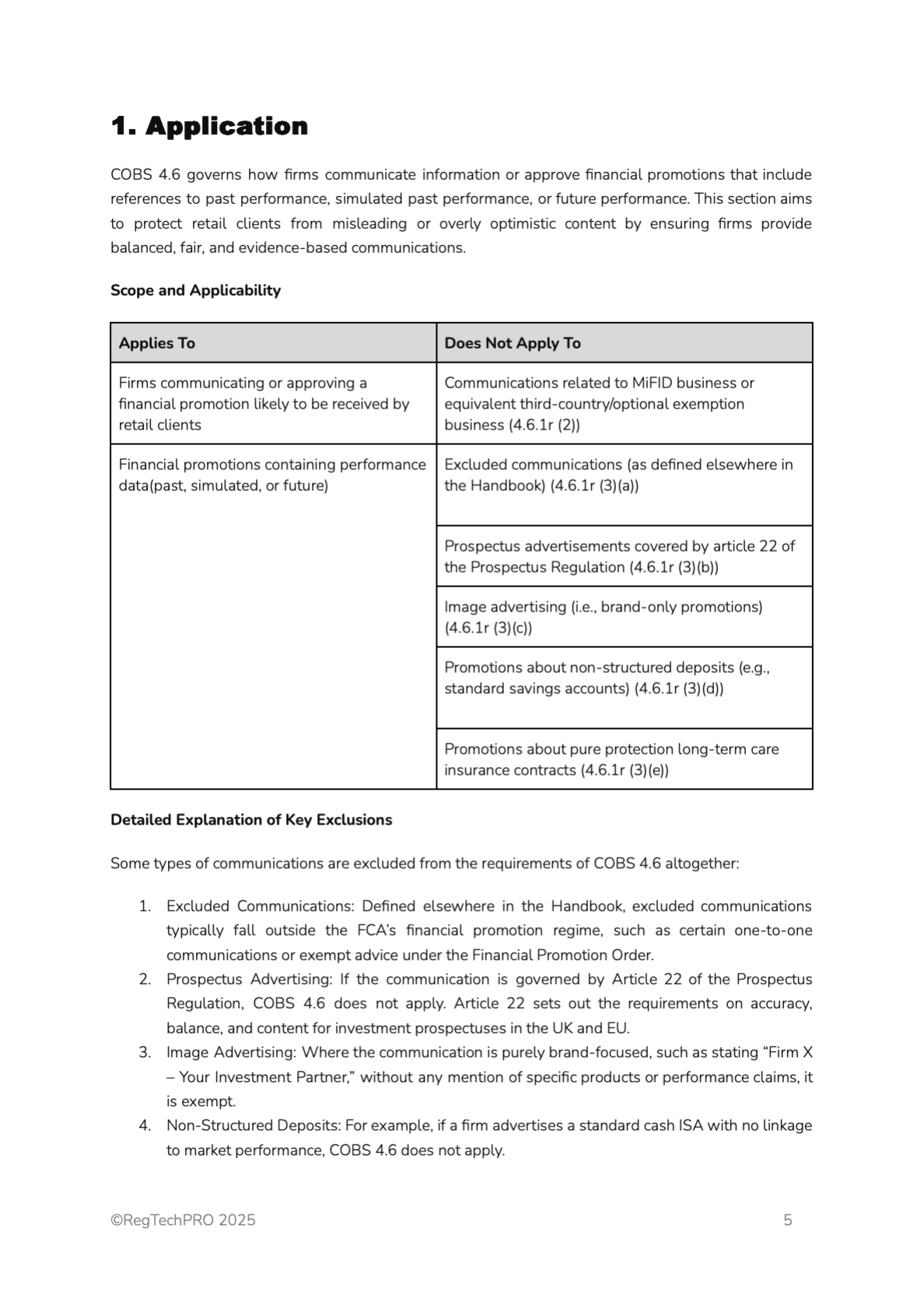

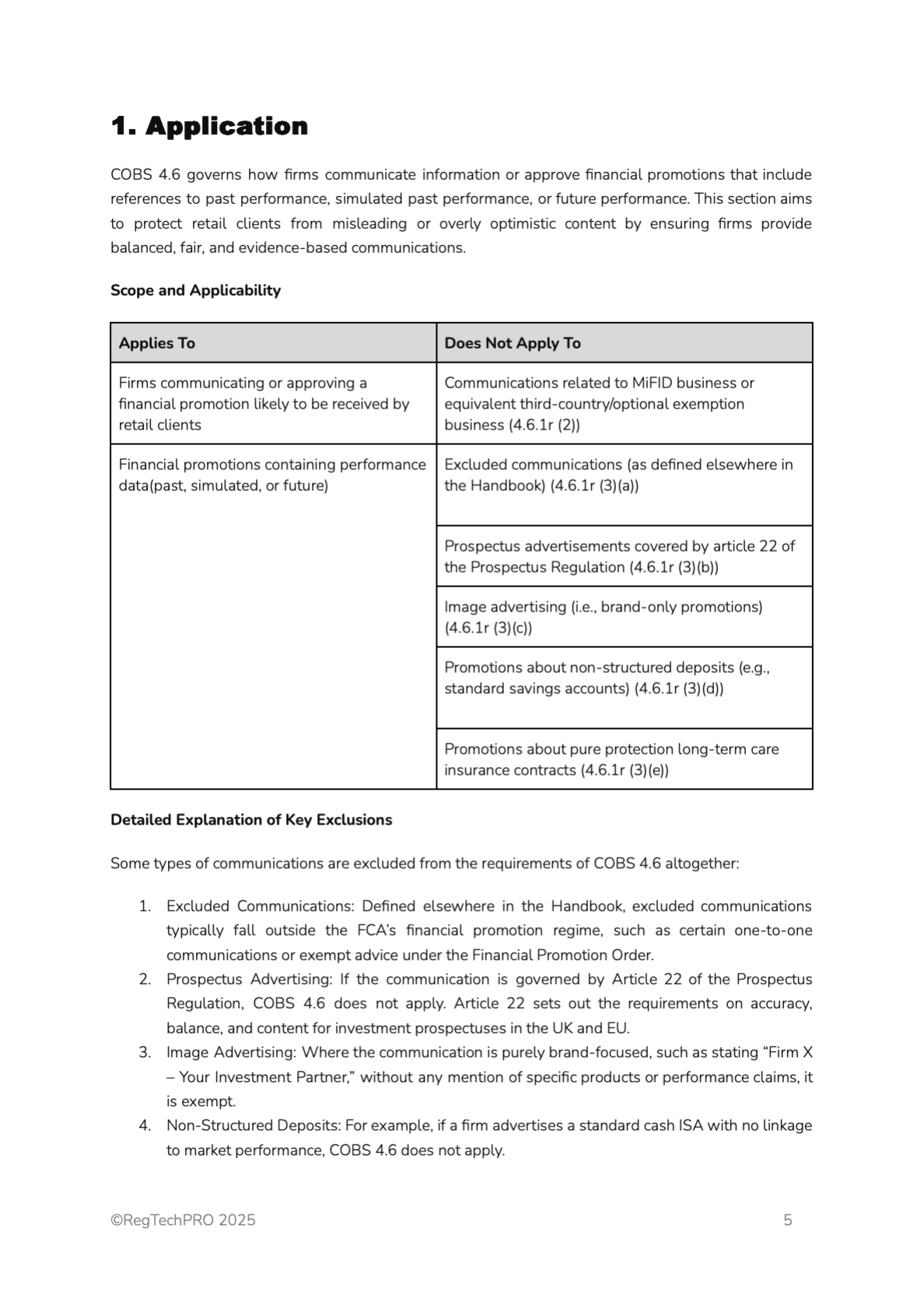

Get a fully editable COBS 4.6 – Performance Communications Guide (Non-MiFID), designed to help firms meet the FCA’s requirements for referencing investment performance in financial promotions to non-MiFID clients, including occupational pension schemes and trustees. This guide provides practical direction on how to apply the COBS 4.6.9G–4.6.11G provisions for past, simulated past, and future performance, ensuring clarity, balance, and compliance when MiFID rules do not apply.

The guide explains how to fairly present performance information in non-MiFID contexts, outlining the differences in expectations compared to MiFID provisions. It includes guidance on appropriate disclaimers, historical consistency, prominence of risk warnings, and cautions around forward-looking statements. Key focus areas include avoiding misleading content, especially where complex or high-risk products are promoted to non-MiFID audiences.

The guide includes real-life examples and sample templates for structuring promotional content in documents, factsheets, emails, and digital formats. It also outlines internal review processes, giving compliance officers and marketing teams tools to evaluate and approve performance claims consistently and in accordance with FCA expectations. Emphasis is placed on applying a consumer understanding lens, in accordance with the Consumer Duty.

Additional content helps firms align these performance communications with wider governance frameworks, including financial promotions policies, training modules, and board oversight. It also includes monitoring suggestions and post-distribution review steps to ensure communications remain compliant as products evolve or markets shift.

This Microsoft Word guide is instantly downloadable and fully editable. It is ideal for investment firms, SIPP providers, DFMs, and compliance consultants. It saves time, reduces the risk of regulatory breaches, and helps firms communicate investment performance accurately and transparently to non-MiFID audiences, ensuring fair treatment and clear understanding throughout.

Length: 16 Pages

Applies to: Investment Firms

Fully Customisable COBS 4.6 Guide – Past, Simulated Past & Future Performance (Non-MiFID Provisions)

Get a fully editable COBS 4.6 – Performance Communications Guide (Non-MiFID), designed to help firms meet the FCA’s requirements for referencing investment performance in financial promotions to non-MiFID clients, including occupational pension schemes and trustees. This guide provides practical direction on how to apply the COBS 4.6.9G–4.6.11G provisions for past, simulated past, and future performance, ensuring clarity, balance, and compliance when MiFID rules do not apply.

The guide explains how to fairly present performance information in non-MiFID contexts, outlining the differences in expectations compared to MiFID provisions. It includes guidance on appropriate disclaimers, historical consistency, prominence of risk warnings, and cautions around forward-looking statements. Key focus areas include avoiding misleading content, especially where complex or high-risk products are promoted to non-MiFID audiences.

The guide includes real-life examples and sample templates for structuring promotional content in documents, factsheets, emails, and digital formats. It also outlines internal review processes, giving compliance officers and marketing teams tools to evaluate and approve performance claims consistently and in accordance with FCA expectations. Emphasis is placed on applying a consumer understanding lens, in accordance with the Consumer Duty.

Additional content helps firms align these performance communications with wider governance frameworks, including financial promotions policies, training modules, and board oversight. It also includes monitoring suggestions and post-distribution review steps to ensure communications remain compliant as products evolve or markets shift.

This Microsoft Word guide is instantly downloadable and fully editable. It is ideal for investment firms, SIPP providers, DFMs, and compliance consultants. It saves time, reduces the risk of regulatory breaches, and helps firms communicate investment performance accurately and transparently to non-MiFID audiences, ensuring fair treatment and clear understanding throughout.

Length: 16 Pages

Applies to: Investment Firms

Fully Customisable COBS 4.6 Guide – Past, Simulated Past & Future Performance (Non-MiFID Provisions)

Get a fully editable COBS 4.6 – Performance Communications Guide (Non-MiFID), designed to help firms meet the FCA’s requirements for referencing investment performance in financial promotions to non-MiFID clients, including occupational pension schemes and trustees. This guide provides practical direction on how to apply the COBS 4.6.9G–4.6.11G provisions for past, simulated past, and future performance, ensuring clarity, balance, and compliance when MiFID rules do not apply.

The guide explains how to fairly present performance information in non-MiFID contexts, outlining the differences in expectations compared to MiFID provisions. It includes guidance on appropriate disclaimers, historical consistency, prominence of risk warnings, and cautions around forward-looking statements. Key focus areas include avoiding misleading content, especially where complex or high-risk products are promoted to non-MiFID audiences.

The guide includes real-life examples and sample templates for structuring promotional content in documents, factsheets, emails, and digital formats. It also outlines internal review processes, giving compliance officers and marketing teams tools to evaluate and approve performance claims consistently and in accordance with FCA expectations. Emphasis is placed on applying a consumer understanding lens, in accordance with the Consumer Duty.

Additional content helps firms align these performance communications with wider governance frameworks, including financial promotions policies, training modules, and board oversight. It also includes monitoring suggestions and post-distribution review steps to ensure communications remain compliant as products evolve or markets shift.

This Microsoft Word guide is instantly downloadable and fully editable. It is ideal for investment firms, SIPP providers, DFMs, and compliance consultants. It saves time, reduces the risk of regulatory breaches, and helps firms communicate investment performance accurately and transparently to non-MiFID audiences, ensuring fair treatment and clear understanding throughout.