Image 1 of 5

Image 1 of 5

Image 2 of 5

Image 2 of 5

Image 3 of 5

Image 3 of 5

Image 4 of 5

Image 4 of 5

Image 5 of 5

Image 5 of 5

Communicating with Non-MiFID Clients for Investment Promotions

Length: 9 Pages

Applies to: Investment Firms

Fully Customisable COBS 4.5 Guide – Communicating with Non-MiFID Clients

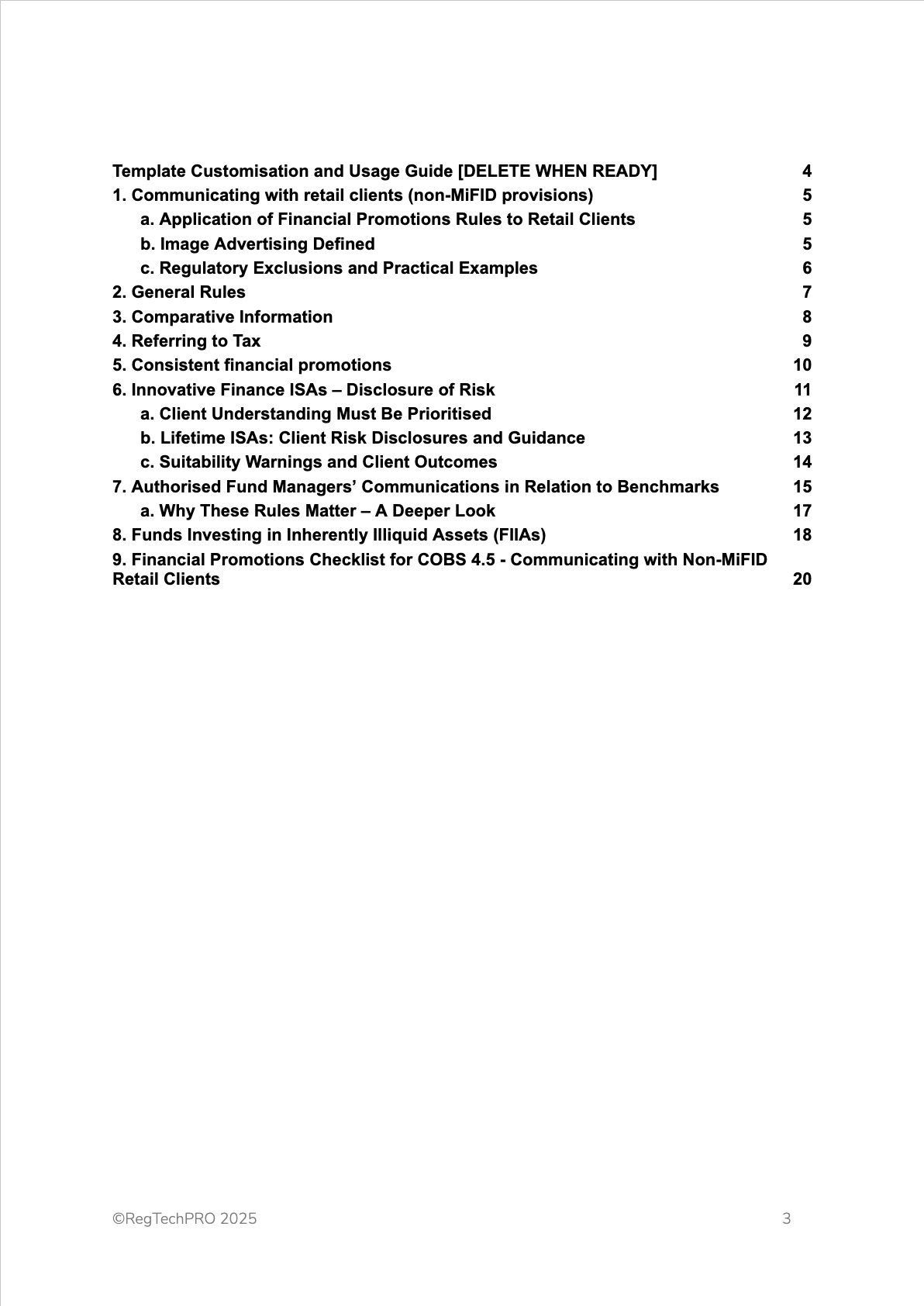

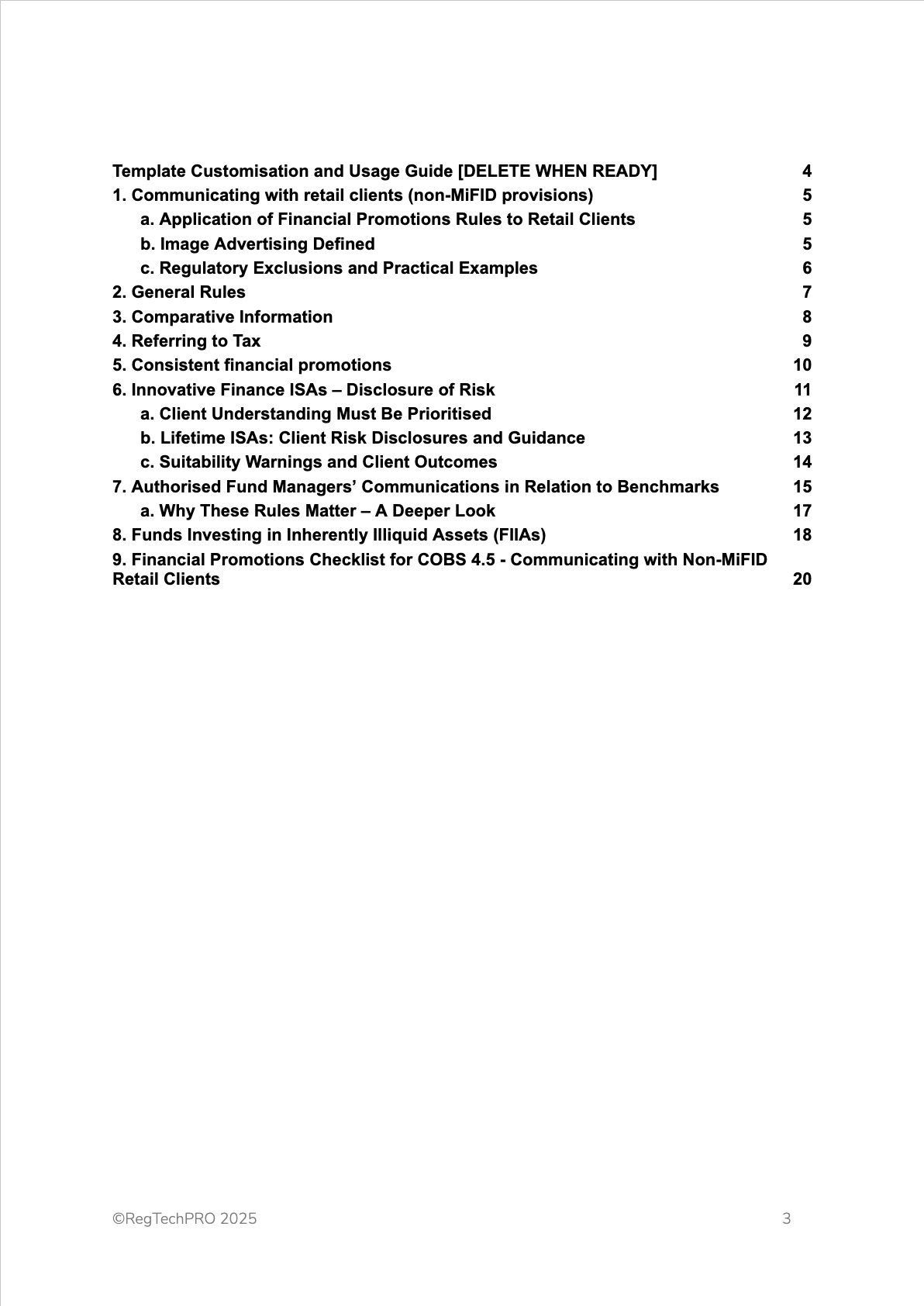

Get a fully editable COBS 4.5 – Communicating with Non-Mifid Clients Guide, designed to help investment firms understand and meet the FCA’s bespoke conduct rules for financial promotions and communications targeted at clients not covered under MiFID II. This includes occupational pension schemes, trustees, and local authorities, where specific communication requirements apply. The guide translates the nuanced expectations of COBS 4.5.1R–4.5.4G into actionable compliance practices.

The guide explains how COBS 4.5 diverges from MiFID II standards, clearly presenting risk warnings, performance data, charges, and promotional claims when dealing with these distinct client types. It includes clear direction on how to tailor communications based on client categorisation, especially where clients might not have access to recourse under the FSCS or FOS, or where certain MiFID protections don’t apply.

It walks compliance officers and marketing teams through building internal controls, reviewing language for clarity and suitability, and applying a risk-based approach to non-MiFID client segments. A range of examples, common pitfalls, and sample disclaimers are included to support firms in avoiding misleading communications, ensuring all content is fair, accurate, and appropriate for the intended audience.

The document also guides aligning communication practices with PRIN, Consumer Duty, and other cross-cutting rules, ensuring that even non-MiFID clients are treated fairly and receive communications supporting informed decision-making. The guide includes tools for pre-approval checklists, compliance sign-off, and post-distribution monitoring.

This Microsoft Word guide is instantly downloadable and fully editable. It is ideal for investment managers, pension scheme administrators, discretionary fund managers, and compliance professionals. It saves time while strengthening governance, improving client understanding, and ensuring firms meet their regulatory obligations when dealing with non-MiFID audiences.

Length: 9 Pages

Applies to: Investment Firms

Fully Customisable COBS 4.5 Guide – Communicating with Non-MiFID Clients

Get a fully editable COBS 4.5 – Communicating with Non-Mifid Clients Guide, designed to help investment firms understand and meet the FCA’s bespoke conduct rules for financial promotions and communications targeted at clients not covered under MiFID II. This includes occupational pension schemes, trustees, and local authorities, where specific communication requirements apply. The guide translates the nuanced expectations of COBS 4.5.1R–4.5.4G into actionable compliance practices.

The guide explains how COBS 4.5 diverges from MiFID II standards, clearly presenting risk warnings, performance data, charges, and promotional claims when dealing with these distinct client types. It includes clear direction on how to tailor communications based on client categorisation, especially where clients might not have access to recourse under the FSCS or FOS, or where certain MiFID protections don’t apply.

It walks compliance officers and marketing teams through building internal controls, reviewing language for clarity and suitability, and applying a risk-based approach to non-MiFID client segments. A range of examples, common pitfalls, and sample disclaimers are included to support firms in avoiding misleading communications, ensuring all content is fair, accurate, and appropriate for the intended audience.

The document also guides aligning communication practices with PRIN, Consumer Duty, and other cross-cutting rules, ensuring that even non-MiFID clients are treated fairly and receive communications supporting informed decision-making. The guide includes tools for pre-approval checklists, compliance sign-off, and post-distribution monitoring.

This Microsoft Word guide is instantly downloadable and fully editable. It is ideal for investment managers, pension scheme administrators, discretionary fund managers, and compliance professionals. It saves time while strengthening governance, improving client understanding, and ensuring firms meet their regulatory obligations when dealing with non-MiFID audiences.

Length: 9 Pages

Applies to: Investment Firms

Fully Customisable COBS 4.5 Guide – Communicating with Non-MiFID Clients

Get a fully editable COBS 4.5 – Communicating with Non-Mifid Clients Guide, designed to help investment firms understand and meet the FCA’s bespoke conduct rules for financial promotions and communications targeted at clients not covered under MiFID II. This includes occupational pension schemes, trustees, and local authorities, where specific communication requirements apply. The guide translates the nuanced expectations of COBS 4.5.1R–4.5.4G into actionable compliance practices.

The guide explains how COBS 4.5 diverges from MiFID II standards, clearly presenting risk warnings, performance data, charges, and promotional claims when dealing with these distinct client types. It includes clear direction on how to tailor communications based on client categorisation, especially where clients might not have access to recourse under the FSCS or FOS, or where certain MiFID protections don’t apply.

It walks compliance officers and marketing teams through building internal controls, reviewing language for clarity and suitability, and applying a risk-based approach to non-MiFID client segments. A range of examples, common pitfalls, and sample disclaimers are included to support firms in avoiding misleading communications, ensuring all content is fair, accurate, and appropriate for the intended audience.

The document also guides aligning communication practices with PRIN, Consumer Duty, and other cross-cutting rules, ensuring that even non-MiFID clients are treated fairly and receive communications supporting informed decision-making. The guide includes tools for pre-approval checklists, compliance sign-off, and post-distribution monitoring.

This Microsoft Word guide is instantly downloadable and fully editable. It is ideal for investment managers, pension scheme administrators, discretionary fund managers, and compliance professionals. It saves time while strengthening governance, improving client understanding, and ensuring firms meet their regulatory obligations when dealing with non-MiFID audiences.